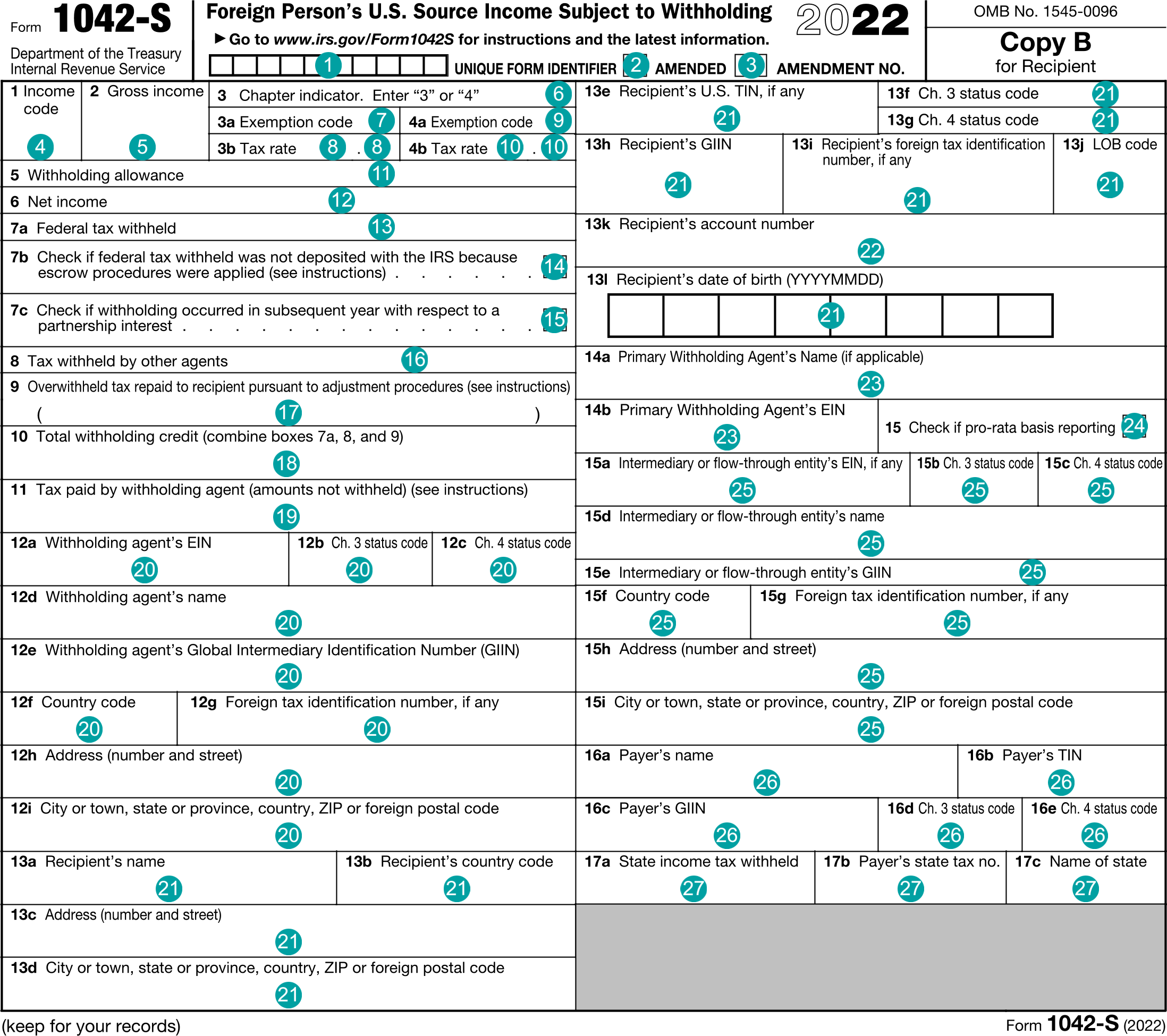

1042-S : Foreign Person's U.S. Source Income Subject to Withholding

FDX

FDX / Data Structures / Tax1042S

Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding

Extends and inherits all fields from Tax

Tax1042S Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | formId | string | Unique form identifier |

| 2 | amended | boolean | Amended |

| 3 | amendmentNumber | integer | Amendment number |

| 4 | incomeTypeCode | string | Box 1, Income code |

| 5 | grossIncome | number (double) | Box 2, Gross income |

| 6 | chapterIndicator | string | Box 3, Chapter indicator |

| 7 | ch3ExemptionCode | string | Box 3a, Exemption code |

| 8 | ch3TaxRate | number (double) | Box 3b, Tax rate |

| 9 | ch4ExemptionCode | string | Box 4a, Exemption code |

| 10 | ch4TaxRate | number (double) | Box 4b, Tax rate |

| 11 | withholdingAllowance | number (double) | Box 5, Withholding allowance |

| 12 | netIncome | number (double) | Box 6, Net income |

| 13 | federalTaxWithheld | number (double) | Box 7a, Federal tax withheld |

| 14 | escrowProceduresApplied | boolean | Box 7b, Check if federal tax withheld was not deposited with the IRS because escrow procedures were applied |

| 15 | subsequentYear | boolean | Box 7c, Check if withholding occurred in subsequent year with respect to a partnership interest |

| 16 | otherAgentsTaxWithheld | number (double) | Box 8, Tax withheld by other agents |

| 17 | recipientRepaidAmount | number (double) | Box 9, Overwithheld tax repaid to recipient pursuant to adjustment procedures |

| 18 | totalTaxWithholdingCredit | number (double) | Box 10, Total withholding credit |

| 19 | withholdingAgentTaxPaid | number (double) | Box 11, Tax paid by withholding agent (amounts not withheld) |

| 20 | withholdingAgent | Form1042Agent | Box 12, Withholding agent |

| 21 | recipient | Form1042Recipient | Box 13, Recipient |

| 22 | accountNumber | string | Box 13k, Recipient account number |

| 23 | primary | Form1042Agent | Box 14, Primary Withholding Agent |

| 24 | prorataBasisReporting | boolean | Box 15, Check if pro-rata basis reporting |

| 25 | intermediary | Form1042Agent | Box 15, Intermediary or flow thru entity |

| 26 | payer | Form1042Agent | Box 16, Payer |

| 27 | stateTaxWithholding | StateTaxWithholding | Box 17, State tax withholding |

Tax1042S Usage:

- TaxData tax1042S

OFX

The OFX standard does not support this form.

FIRE

This form is not reported in the IRS FIRE system.

TXF

The TXF standard does not support this form.