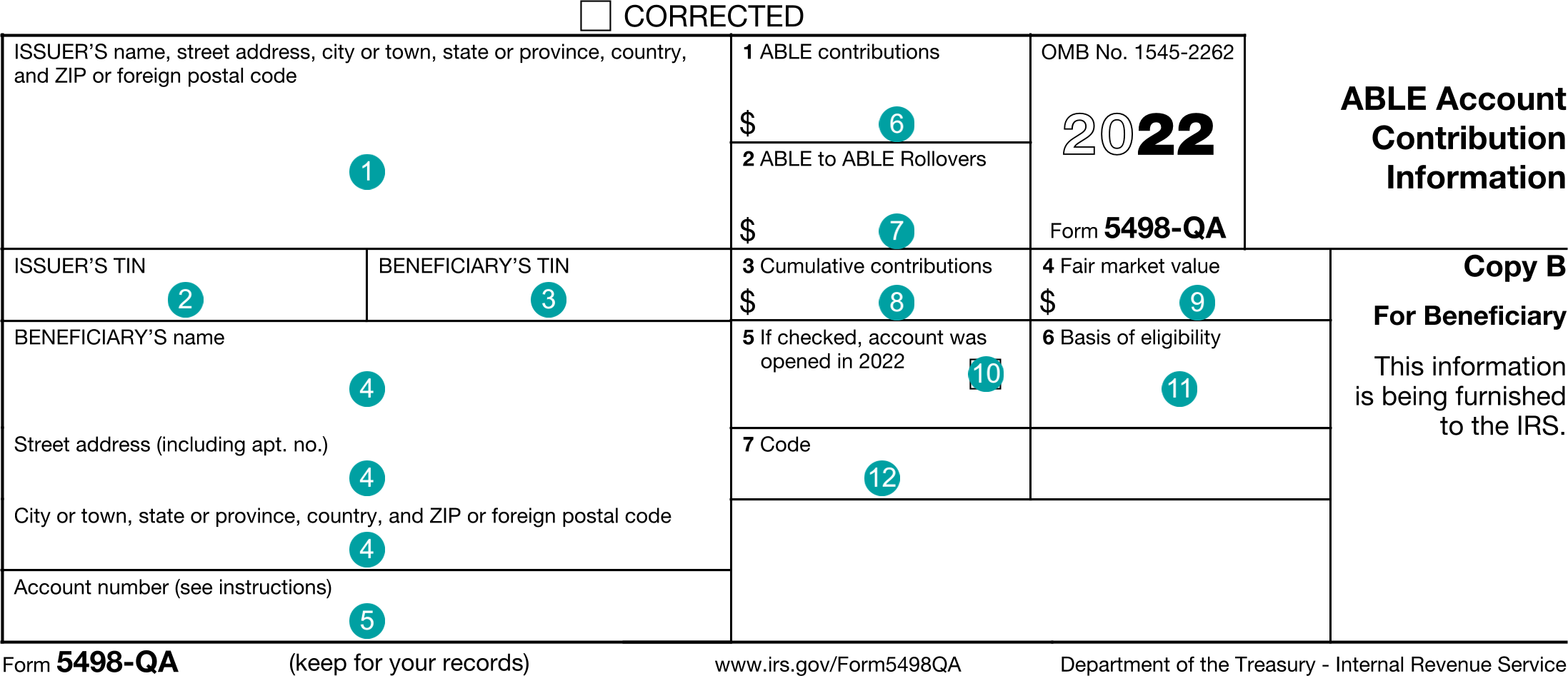

5498-QA : ABLE Account Contribution Information

FDX

FDX / Data Structures / Tax5498Qa

Form 5498-QA, ABLE Account Contribution Information

Extends and inherits all fields from Tax

Tax5498Qa Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | issuerNameAddress | NameAddress | ISSUER'S name, street address, city or town, state or province, country, and ZIP or foreign postal code |

| 2 | issuerTin | string | ISSUER'S TIN |

| 3 | beneficiaryTin | string | BENEFICIARY'S TIN |

| 4 | beneficiaryNameAddress | NameAddress | BENEFICIARY'S name and address |

| 5 | accountNumber | string | Account number |

| 6 | ableContributions | number (double) | Box 1, ABLE contributions |

| 7 | rollovers | number (double) | Box 2, ABLE to ABLE Rollovers |

| 8 | cumulativeContributions | number (double) | Box 3, Cumulative contributions |

| 9 | fairMarketValue | number (double) | Box 4, Fair market value |

| 10 | openedInTaxYear | boolean | Box 5, Check if account opened in current tax year |

| 11 | basisOfDisabilityCode | string | Box 6, Basis of eligibility |

| 12 | typeOfDisabilityCode | string | Box 7, Code |

Tax5498Qa Usage:

- TaxData tax5498Qa

OFX

The OFX standard does not support this form.

FIRE

This form is not reported in the IRS FIRE system.

TXF

The TXF standard does not support this form.