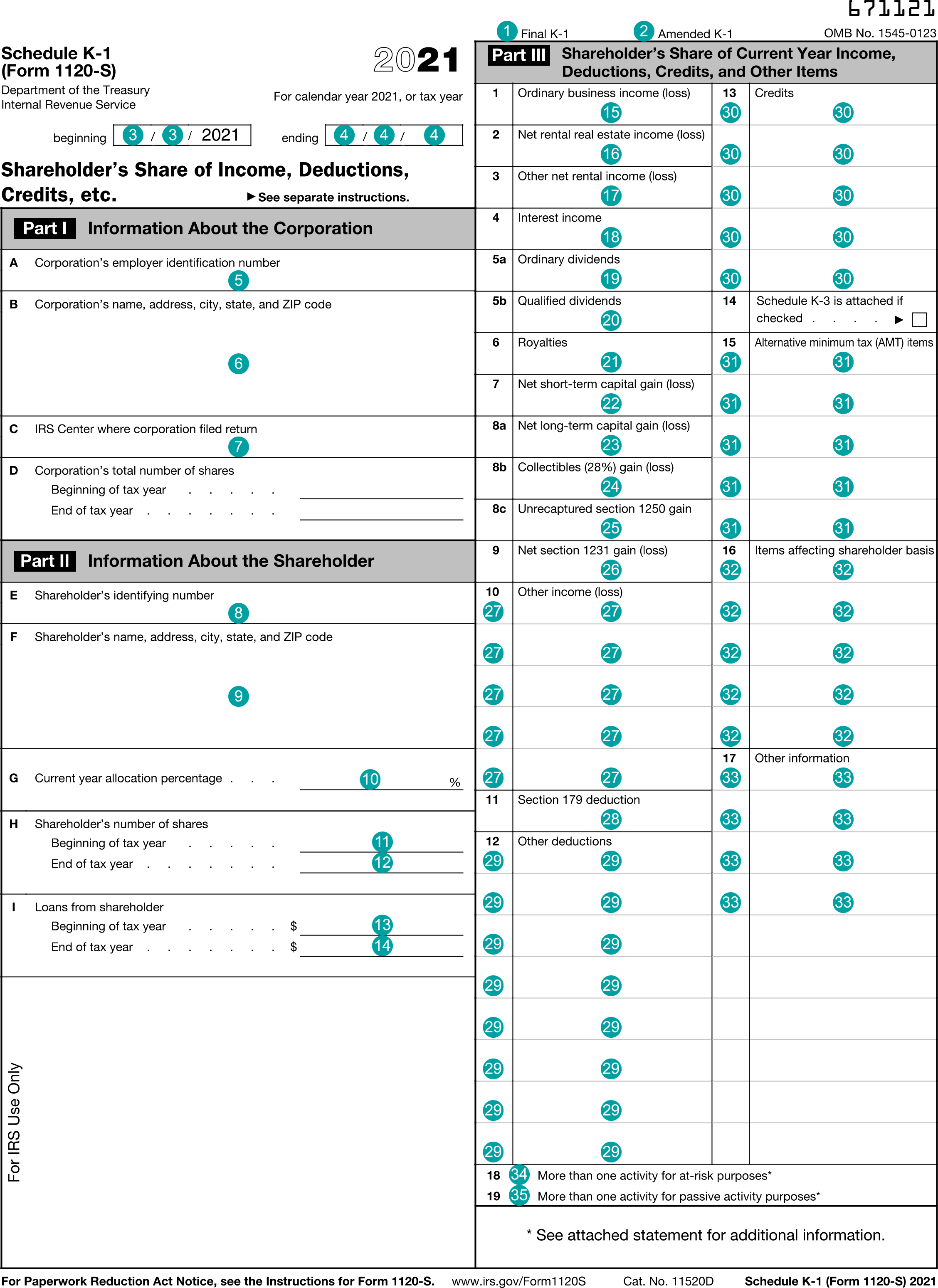

1120S K-1 : Shareholder's Share of Income, Deductions, Credits, etc.

FDX

FDX / Data Structures / Tax1120SK1

Form 1120-S K-1, Shareholder's Share of Income, Deductions, Credits, etc.

Extends and inherits all fields from Tax

Tax1120SK1 Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | finalK1 | boolean | Final K-1 |

| 2 | amendedK1 | boolean | Amended K-1 |

| 3 | fiscalYearBegin | DateString | Fiscal year begin date |

| 4 | fiscalYearEnd | DateString | Fiscal year end date |

| 5 | corporationTin | string | Box A, Corporation's employer identification number |

| 6 | corporationNameAddress | NameAddress | Box B, Corporation's name, address, city, state, and ZIP code |

| 7 | irsCenter | string | Box C, IRS Center where corporation filed return |

| 8 | corporationBeginningShares | number (double) | Box D, Corporation's total number of shares, Beginning of tax year |

| 9 | corporationEndingShares | number (double) | Box D, Corporation's total number of shares, End of tax year |

| 10 | shareholderTin | string | Box E, Shareholder's identifying number |

| 11 | shareholderNameAddress | NameAddress | Box F, Shareholder's name, address, city, state, and ZIP code |

| 12 | percentOwnership | number (double) | Box G, Current year allocation percentage |

| 13 | beginningShares | number (double) | Box H, Shareholder's number of shares, Beginning of tax year |

| 14 | endingShares | number (double) | Box H, Shareholder's number of shares, End of tax year |

| 15 | beginningLoans | number (double) | Box I, Loans from shareholder, Beginning of tax year |

| 16 | endingLoans | number (double) | Box I, Loans from shareholder, Ending of tax year |

| 17 | ordinaryIncome | number (double) | Box 1, Ordinary business income (loss) |

| 18 | netRentalRealEstateIncome | number (double) | Box 2, Net rental real estate income (loss) |

| 19 | otherRentalIncome | number (double) | Box 3, Other net rental income (loss) |

| 20 | interestIncome | number (double) | Box 4, Interest income |

| 21 | ordinaryDividends | number (double) | Box 5a, Ordinary dividends |

| 22 | qualifiedDividends | number (double) | Box 5b, Qualified dividends |

| 23 | royalties | number (double) | Box 6, Royalties |

| 24 | netShortTermGain | number (double) | Box 7, Net short-term capital gain (loss) |

| 25 | netLongTermGain | number (double) | Box 8a, Net long-term capital gain (loss) |

| 26 | collectiblesGain | number (double) | Box 8b, Collectibles (28%) gain (loss) |

| 27 | unrecaptured1250Gain | number (double) | Box 8c, Unrecaptured section 1250 gain |

| 28 | net1231Gain | number (double) | Box 9, Net section 1231 gain (loss) |

| 29 | otherIncome | Array of CodeAmount | Box 10, Other income (loss) |

| 30 | section179Deduction | number (double) | Box 11, Section 179 deduction |

| 31 | otherDeductions | Array of CodeAmount | Box 12, Other deductions |

| 32 | credits | Array of CodeAmount | Box 13, Credits |

| 33 | scheduleK3 | boolean | Box 14, Schedule K-3 is attached |

| 34 | foreignTransactions | Array of CodeAmount | Box 14, Foreign transactions. IRS deprecated 2021 and is now reported on Schedule K-3 |

| 35 | foreignCountry | string | Box 14, Foreign country. IRS deprecated 2021 and is now reported on Schedule K-3 |

| 36 | amtItems | Array of CodeAmount | Box 15, Alternative minimum tax (AMT) items |

| 37 | basisItems | Array of CodeAmount | Box 16, Items affecting shareholder basis |

| 38 | otherInfo | Array of CodeAmount | Box 17, Other information |

| 39 | multipleAtRiskActivities | boolean | Box 18, More than one activity for at-risk purposes |

| 40 | multiplePassiveActivities | boolean | Box 19, More than one activity for passive activity purposes |

Tax1120SK1 Usage:

- TaxData tax1120SK1

OFX

OFX / Types / Tax1120SK1_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | FINALK1 | BooleanType |

| 6 | AMENDEDK1 | BooleanType |

| 7 | CORPNAME | GenericNameType |

| 8 | CORPEIN | GenericNameType |

| 9 | CORPADDRESS | anonymous complex type |

| 10 | IRSCENTER | GenericNameType |

| 11 | SHAREHOLDERID | GenericNameType |

| 12 | SHAREHOLDERNAME | GenericNameType |

| 13 | SHAREHOLDERADDRESS | anonymous complex type |

| 14 | PERCENTAGESTOCKOWNERSHIP | AmountType |

| 15 | SHARESBOY | AmountType |

| 16 | SHARESEOY | AmountType |

| 17 | LOANSBOY | AmountType |

| 18 | LOANSEOY | AmountType |

| 19 | ORDINARYINCOME | AmountType |

| 20 | NETRENTALREINCOME | AmountType |

| 21 | OTHERRENTALINCOME | AmountType |

| 22 | INTERESTINCOME | AmountType |

| 23 | ORDINARYDIVIDEND | AmountType |

| 24 | QUALIFIEDDIVIDEND | AmountType |

| 25 | ROYALTIES | AmountType |

| 26 | NETSTCAPITALGAIN | AmountType |

| 27 | NETLTCAPITALGAIN | AmountType |

| 28 | COLLECTIBLES | AmountType |

| 29 | UNRECAPSEC1250GAIN | AmountType |

| 30 | NETSEC1231GAIN | AmountType |

| 31 | OTHERINCOMELOSS | CodeAmountType |

| 32 | SEC179DEDUCT | AmountType |

| 33 | OTHERDEDUCTIONS | CodeAmountType |

| 34 | CREDITS | CodeAmountType |

| 35 | FOREIGNCOUNTRY | GenericNameType |

| 36 | FOREIGNTRANSACTIONS | CodeAmountType |

| 37 | AMTITEMS | CodeAmountType |

| 38 | ITEMSAFFECTINGSHAREHOLDERBASIS | CodeAmountType |

| 39 | OTHERINFO | CodeAmountType |

| 40 | FISCALYEARBEGIN | DateTimeType |

| 41 | FISCALYEAREND | DateTimeType |

| 42 | MULTIPLEATRISKACTIVITIES | BooleanType |

| 43 | MULTIPLEPASSIVEACTIVITIES | BooleanType |

Usages:

- TaxK1Response TAX1120SK1_V100

FIRE

This form is not reported in the IRS FIRE system.

TXF

The TXF standard does not support this form.