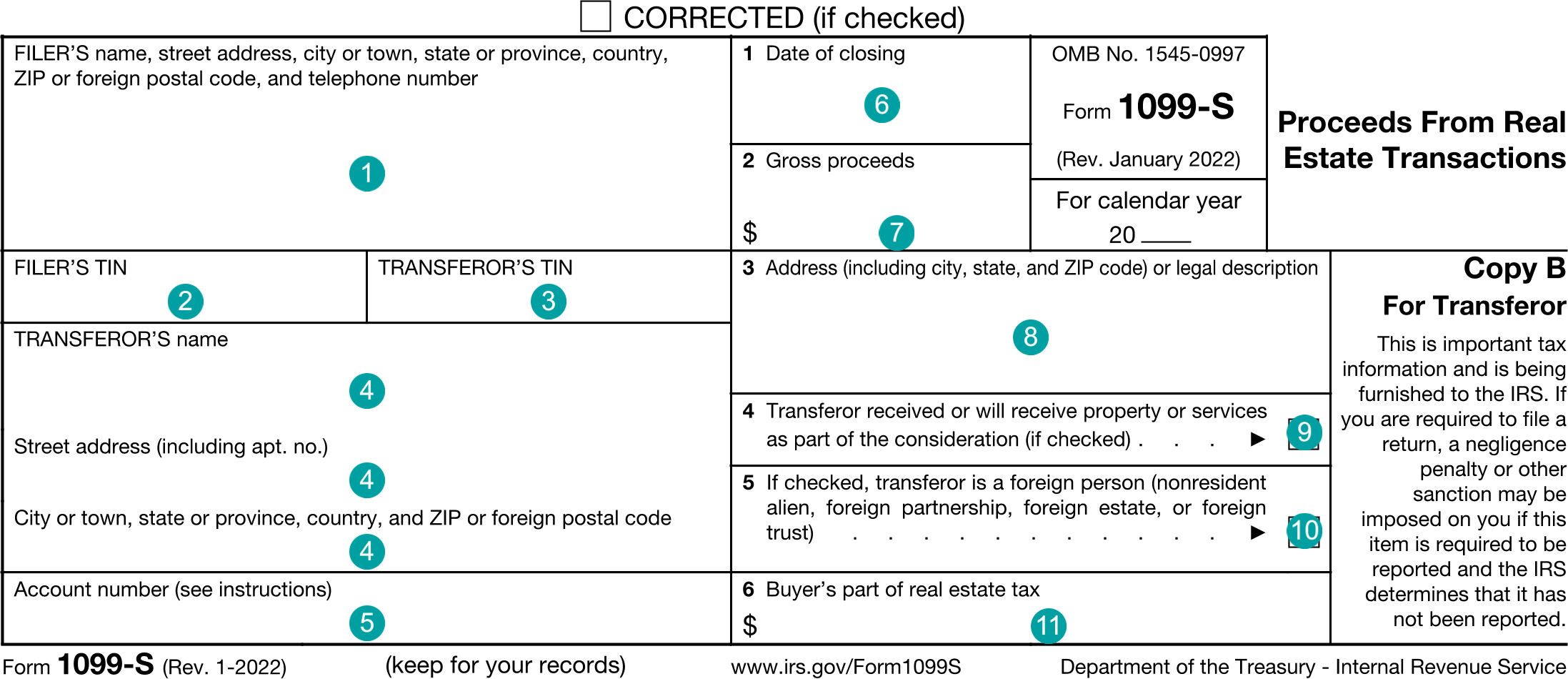

1099-S : Proceeds From Real Estate Transactions

FDX

FDX / Data Structures / Tax1099S

Form 1099-S, Proceeds From Real Estate Transactions

Extends and inherits all fields from Tax

Tax1099S Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | filerNameAddress | NameAddressPhone | Filer's name, address, and phone |

| 2 | filerTin | string | FILER'S TIN |

| 3 | transferorTin | string | TRANSFEROR'S TIN |

| 4 | transferorNameAddress | NameAddress | Transferor's name and address |

| 5 | accountNumber | string | Account or escrow number |

| 6 | dateOfClosing | DateString | Box 1, Date of closing |

| 7 | grossProceeds | number (double) | Box 2, Gross proceeds |

| 8 | addressOrLegalDescription | string | Box 3, Address or legal description |

| 9 | receivedOtherConsideration | boolean | Box 4, Transferor received or will receive property or services as part of the consideration (if checked) |

| 10 | foreignPerson | boolean | Box 5, If checked, transferor is a foreign person (nonresident alien, foreign partnership, foreign estate, or foreign trust) |

| 11 | realEstateTax | number (double) | Box 6, Buyer's part of real estate tax |

Tax1099S Usage:

- TaxData tax1099S

OFX

OFX / Types / Tax1099S_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | FILERADDR | FilerAddressType |

| 6 | TRANSFERORADDR | TransferorAddressType |

| 7 | FILERID | GenericNameType |

| 8 | TRANSFERORID | IdType |

| 9 | ACCTNUM | GenericNameType |

| 10 | DATECLOSE | DateTimeType |

| 11 | GROSSPROC | AmountType |

| 12 | ADDRDESC | MessageType |

| 13 | PROPSERV | BooleanType |

| 14 | FOREIGNPERSON | BooleanType |

| 15 | RETAX | AmountType |

Usages:

- Tax1099Response TAX1099S_V100

FIRE

Under Development

TXF

The TXF standard does not support this form.