Tax1099S_V100

OFX / Types / Tax1099S_V100

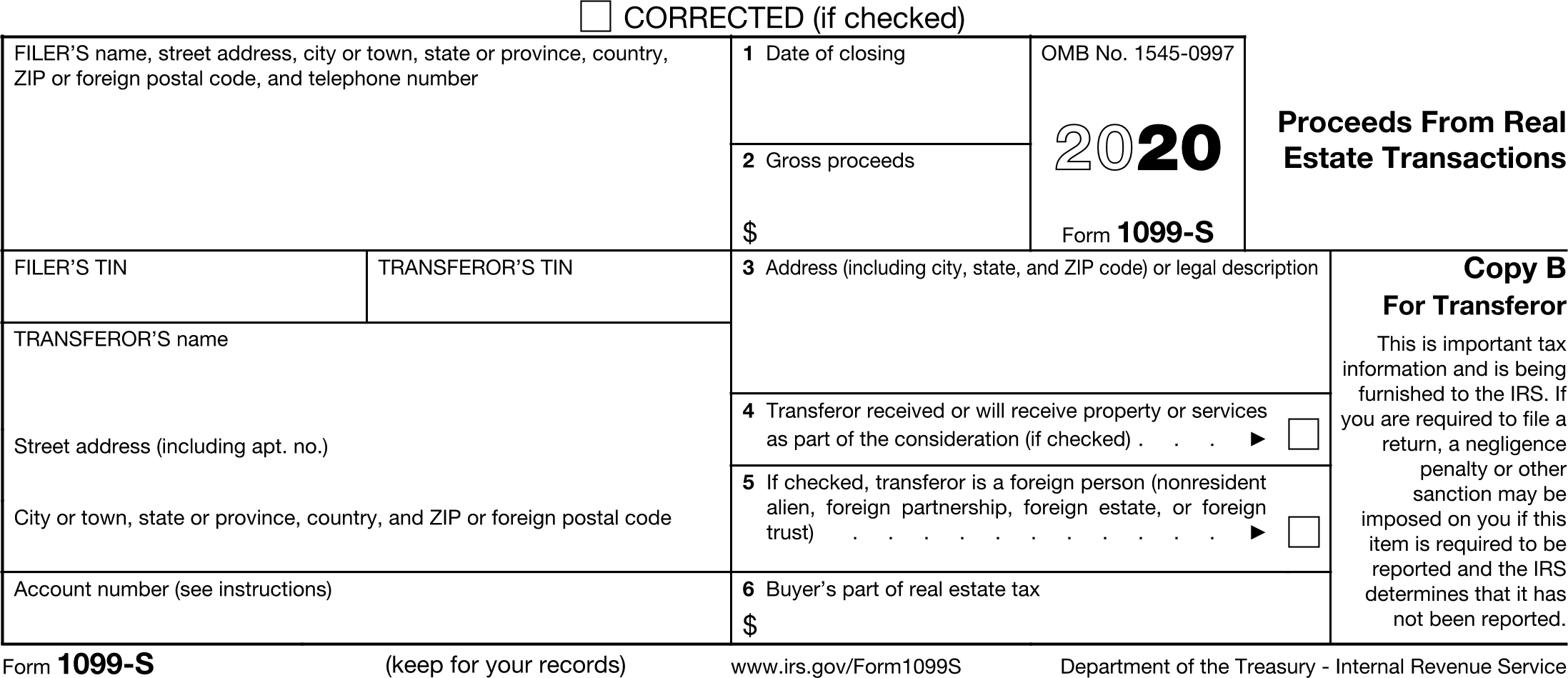

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | FILERADDR | FilerAddressType |

| 6 | TRANSFERORADDR | TransferorAddressType |

| 7 | FILERID | GenericNameType |

| 8 | TRANSFERORID | IdType |

| 9 | ACCTNUM | GenericNameType |

| 10 | DATECLOSE | DateTimeType |

| 11 | GROSSPROC | AmountType |

| 12 | ADDRDESC | MessageType |

| 13 | PROPSERV | BooleanType |

| 14 | FOREIGNPERSON | BooleanType |

| 15 | RETAX | AmountType |

Usages:

- Tax1099Response TAX1099S_V100

XSD

<xsd:complexType name="Tax1099S_V100"> <xsd:annotation> <xsd:documentation>Form 1099-S - Proceeds From Real Estate Transactions</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:AbstractTaxForm1099Type"> <xsd:sequence> <xsd:element name="FILERADDR" type="ofx:FilerAddressType" minOccurs="0"/> <xsd:element name="TRANSFERORADDR" type="ofx:TransferorAddressType" minOccurs="0"/> <xsd:element name="FILERID" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>FILER'S federal identification number</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="TRANSFERORID" type="ofx:IdType" minOccurs="0"> <xsd:annotation> <xsd:documentation>TRANSFEROR'S identification number</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="ACCTNUM" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Account or escrow number</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="DATECLOSE" type="ofx:DateTimeType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 1. Date of closing</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="GROSSPROC" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 2. Gross proceeds</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="ADDRDESC" type="ofx:MessageType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 3. Address or legal description</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PROPSERV" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 4. Transferor received or will receive property or services as part of the consideration (if checked) .</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FOREIGNPERSON" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5. If checked, transferor is a foreign person (nonresident alien, Foreign partnership, foreign estate, or foreign trust)</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="RETAX" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 6. Buyer's part of real estate tax</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:extension> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099S_V100>

<TAXYEAR>2020</TAXYEAR>

<FILERADDR>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

<PHONE>888-555-1212</PHONE>

<FILERNAME1>Financial Data Exchange</FILERNAME1>

</FILERADDR>

<TRANSFERORADDR>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

<TRANSFERORNAME1>Kris Q Public</TRANSFERORNAME1>

</TRANSFERORADDR>

<FILERID>12-3456789</FILERID>

<TRANSFERORID>xxx-xx-1234</TRANSFERORID>

<ACCTNUM>111-23456</ACCTNUM>

<DATECLOSE>20190401</DATECLOSE>

<GROSSPROC>200000.00</GROSSPROC>

<ADDRDESC>2 Main St, Melrose, NY 12121</ADDRDESC>

<PROPSERV>Y</PROPSERV>

<RETAX>600.00</RETAX>

</TAX1099S_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

FDX JSON

{

"tax1099S" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099S",

"filerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"filerTin" : "12-3456789",

"transferorTin" : "xxx-xx-1234",

"transferorNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"accountNumber" : "111-23456",

"dateOfClosing" : "2019-04-01",

"grossProceeds" : 200000.0,

"addressOrLegalDescription" : "2 Main St, Melrose, NY 12121",

"receivedOtherConsideration" : true,

"realEstateTax" : 600.0

}

}