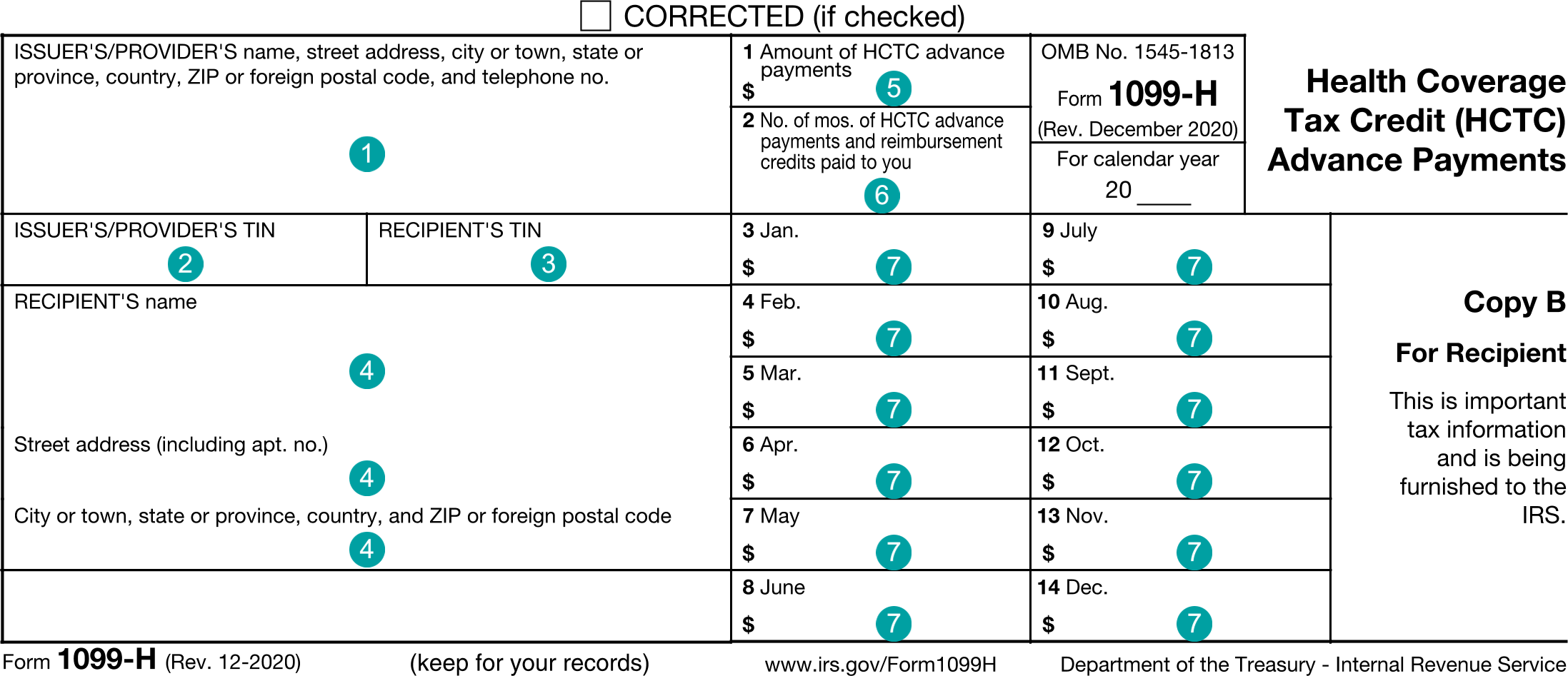

1099-H : Health Coverage Tax Credit (HCTC) Advance Payments

FDX

FDX / Data Structures / Tax1099H

Form 1099-H, 2019 Health Coverage Tax Credit (HCTC) Advance Payments (IRS discontinued in 2020)

Extends and inherits all fields from Tax

Tax1099H Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | issuerNameAddress | NameAddressPhone | Issuer's name, address, and phone |

| 2 | issuerTin | string | ISSUER'S/PROVIDER'S federal identification number |

| 3 | recipientTin | string | RECIPIENT'S identification number |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | advancePayments | number (double) | Box 1, Amount of HCTC advance payments |

| 6 | numberOfMonths | integer | Box 2, Number of months HCTC advance payments and reimbursement credits paid to you |

| 7 | payments | Array of MonthAmount | Boxes 3-14, Payments by month |

Tax1099H Usage:

- TaxData tax1099H

OFX

OFX / Types / Tax1099H_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | ISSUERADDR | IssuerAddressType |

| 6 | RECIPADDR | RecipientAddressType |

| 7 | ISSUERID | GenericNameType |

| 8 | RECID | IdType |

| 9 | ADVANCE | AmountType |

| 10 | NUMMONTHS | MonthType |

| 11 | JAN | AmountType |

| 12 | FEB | AmountType |

| 13 | MAR | AmountType |

| 14 | APR | AmountType |

| 15 | MAY | AmountType |

| 16 | JUN | AmountType |

| 17 | JUL | AmountType |

| 18 | AUG | AmountType |

| 19 | SEP | AmountType |

| 20 | OCT | AmountType |

| 21 | NOV | AmountType |

| 22 | DEC | AmountType |

Usages:

- Tax1099Response TAX1099H_V100

FIRE

Under Development

TXF

The TXF standard does not support this form.