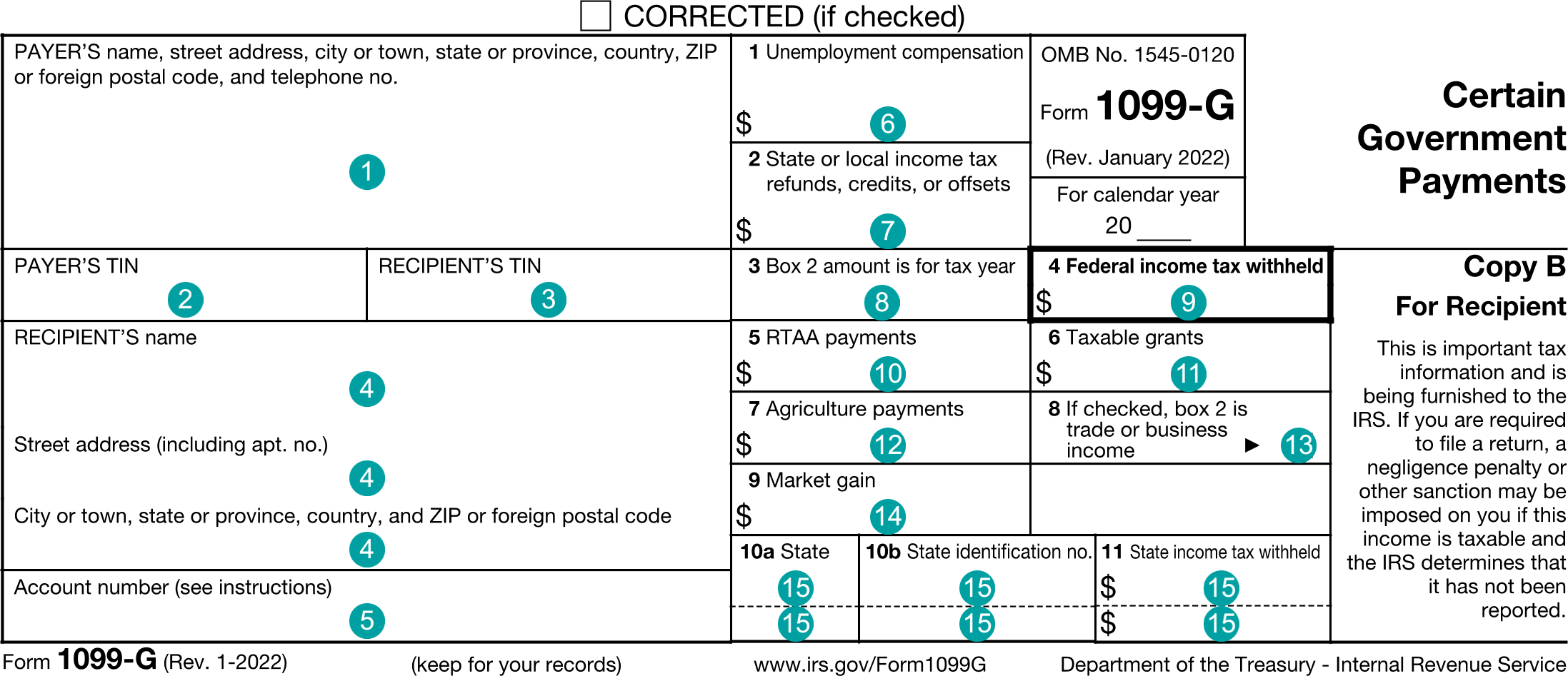

1099-G : Certain Government Payments

FDX

FDX / Data Structures / Tax1099G

Form 1099-G, Certain Government Payments

Extends and inherits all fields from Tax

Tax1099G Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | accountNumber | string | Account number |

| 6 | unemploymentCompensation | number (double) | Box 1, Unemployment compensation |

| 7 | taxRefund | number (double) | Box 2, State or local income tax refunds, credits, or offsets |

| 8 | refundYear | integer | Box 3, Box 2 amount is for tax year |

| 9 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 10 | rtaaPayments | number (double) | Box 5, RTAA payments |

| 11 | grants | number (double) | Box 6, Taxable grants |

| 12 | agriculturePayments | number (double) | Box 7, Agriculture payments |

| 13 | businessIncome | boolean | Box 8, If checked, box 2 is trade or business income |

| 14 | marketGain | number (double) | Box 9, Market gain |

| 15 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 10-11, State tax withholding |

| 16 | secondTinNotice | boolean | Second TIN Notice |

Tax1099G Usage:

- TaxData tax1099G

OFX

OFX / Types / Tax1099G_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | PAYERADDR | PayerAddressType |

| 6 | RECIPADDR | RecipientAddressType |

| 7 | ADDLSTATETAXWHAGG | AddlStateTaxWheldAggregateType |

| 8 | PAYERID | GenericNameType |

| 9 | RECID | IdType |

| 10 | ACCTNUM | GenericNameType |

| 11 | UNEMP | AmountType |

| 12 | STREFUND | AmountType |

| 13 | REFUNDYEAR | YearType |

| 14 | FEDTAXWH | AmountType |

| 15 | RTAA | AmountType |

| 16 | GRANTS | AmountType |

| 17 | AGRPMTS | AmountType |

| 18 | BUSINESSINCOME | BooleanType |

| 19 | MKTGAIN | AmountType |

Usages:

- Tax1099Response TAX1099G_V100

FIRE

Under Development

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 635 | 1099-G | Spouse | 0 | N/A |

| 260 | 1099-G | State and local refunds | 1 | + |

| 479 | 1099-G | Unemployment comp | 1 | + |

| 606 | 1099-G | Fed tax w/h,unemploymt comp | 1 | - |

| 634 | 1099-G | 1099-G | 1 | + |