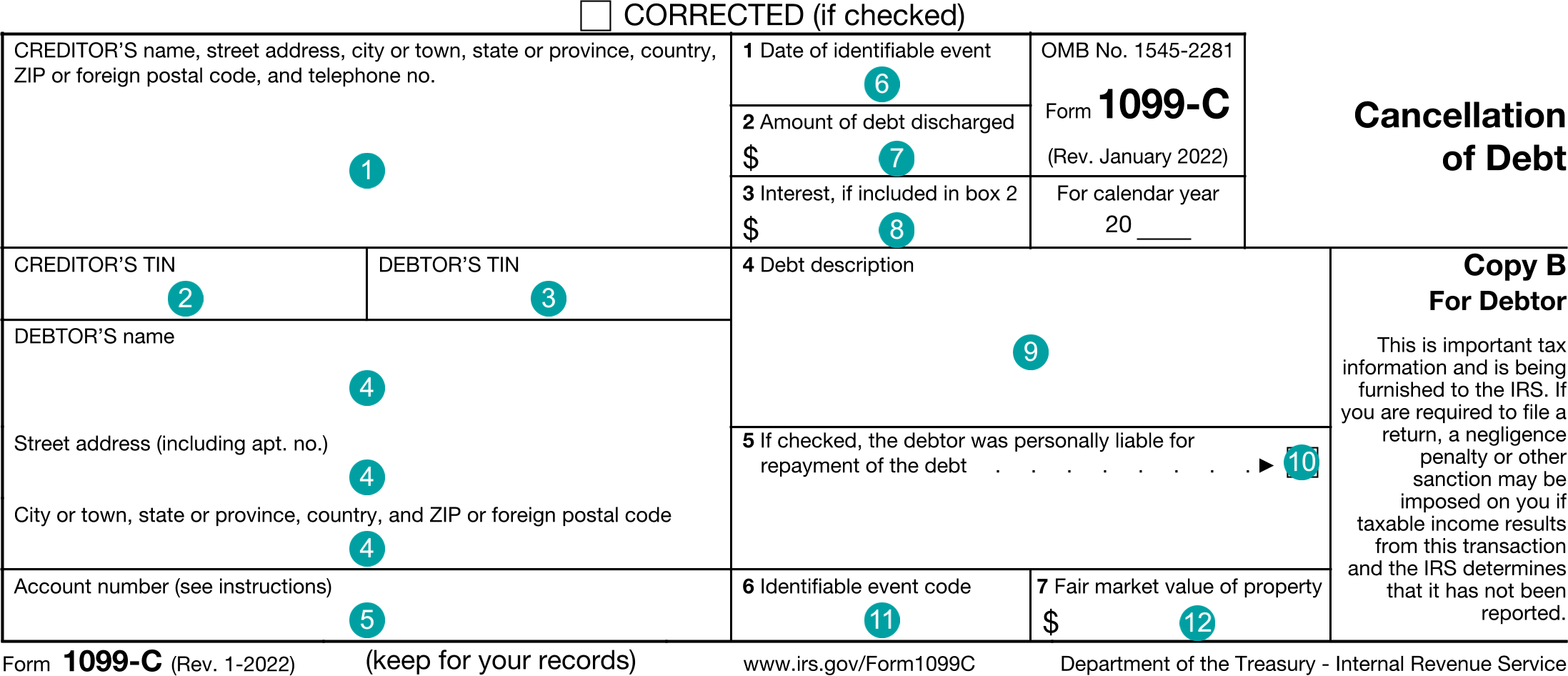

1099-C : Cancellation of Debt

FDX

FDX / Data Structures / Tax1099C

Form 1099-C, Cancellation of Debt

Extends and inherits all fields from Tax

Tax1099C Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | creditorNameAddress | NameAddressPhone | Creditor's name, address, and phone |

| 2 | creditorTin | string | CREDITOR'S TIN |

| 3 | debtorTin | string | DEBTOR'S TIN |

| 4 | debtorNameAddress | NameAddress | Debtor's name and address |

| 5 | accountNumber | string | Account number |

| 6 | dateOfEvent | DateString | Box 1, Date of identifiable event |

| 7 | amountDischarged | number (double) | Box 2, Amount of debt discharged |

| 8 | interestIncluded | number (double) | Box 3, Interest if included in box 2 |

| 9 | debtDescription | string | Box 4, Debt description |

| 10 | personallyLiable | boolean | Box 5, If checked, the debtor was personally liable for repayment of the debt |

| 11 | debtCode | string | Box 6, Identifiable debt code |

| 12 | fairMarketValue | number (double) | Box 7, Fair market value of property |

Tax1099C Usage:

- TaxData tax1099C

OFX

OFX / Types / Tax1099C_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | CREDITORADDR | CreditorAddressType |

| 6 | DEBTORADDR | DebtorAddressType |

| 7 | CREDITORID | GenericNameType |

| 8 | DEBTORID | IdType |

| 9 | ACCTNUM | GenericNameType |

| 10 | DATEEVENT | DateTimeType |

| 11 | DEBTDISCHARGED | AmountType |

| 12 | INTERESTINCL | AmountType |

| 13 | DEBTDESC | MessageType |

| 14 | PERSLIAB | BooleanType |

| 15 | DEBTCODE | GenericNameType |

| 16 | FMVPROP | AmountType |

Usages:

- Tax1099Response TAX1099C_V100

FIRE

Under Development

TXF

The TXF standard does not support this form.