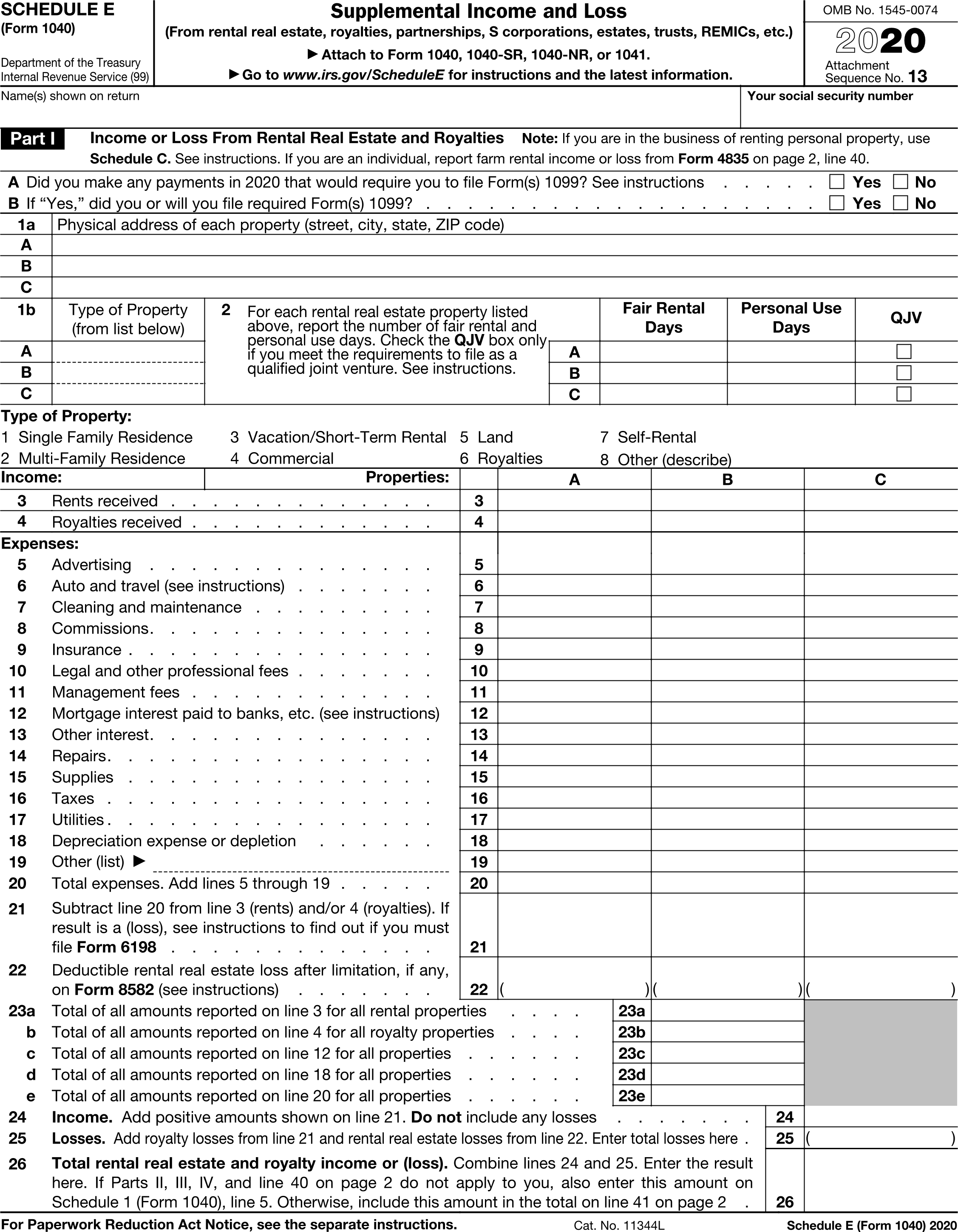

Rental Income Statement : Rental Income Statement for IRS Form 1040 Schedule E

FDX/QR

FDX / Data Structures / RentalIncomeStatement

Rental Income Statement, Rental Income Statement for IRS Form 1040 Schedule E

Extends and inherits all fields from Tax

RentalIncomeStatement Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | propertyAddress | Address | Box 1a, Physical address of property (street, city, state, ZIP code) |

| 2 | rents | number (double) | Box 3, Rents received |

| 3 | advertising | number (double) | Box 5, Advertising |

| 4 | auto | number (double) | Box 6, Auto and travel |

| 5 | cleaning | number (double) | Box 7, Cleaning and maintenance |

| 6 | commissions | number (double) | Box 8, Commissions |

| 7 | insurance | number (double) | Box 9, Insurance |

| 8 | legal | number (double) | Box 10, Legal and other professional fees |

| 9 | managementFees | number (double) | Box 11, Management fees |

| 10 | mortgageInterest | number (double) | Box 12, Mortgage interest paid to banks, etc. |

| 11 | otherInterest | number (double) | Box 13, Other interest |

| 12 | repairs | number (double) | Box 14, Repairs |

| 13 | supplies | number (double) | Box 15, Supplies |

| 14 | taxes | number (double) | Box 16, Taxes |

| 15 | utilities | number (double) | Box 17, Utilities |

| 16 | depreciationExpense | number (double) | Box 18, Depreciation |

| 17 | otherExpenses | Array of DescriptionAmount | Box 19, Other expenses |

| 18 | capitalExpenditures | Array of DateAmount | Capital expenditures, for use in calculating Depreciation |

RentalIncomeStatement Usage:

- TaxData rentalIncomeStatement

OFX

The OFX standard does not support this form.

FIRE

This form is not reported in the IRS FIRE system.

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 325 | E | Schedule E | 1 | + |

| 326 | E | Rents received | 1 | + |

| 327 | E | Royalties received | 1 | + |

| 328 | E | Advertising | 1 | - |

| 329 | E | Auto and travel | 1 | - |

| 330 | E | Cleaning and maintenance | 1 | - |

| 331 | E | Commissions | 1 | - |

| 332 | E | Insurance | 1 | - |

| 333 | E | Legal and professional | 1 | - |

| 334 | E | Mortgage interest exp | 1 | - |

| 335 | E | Other interest expense | 1 | - |

| 336 | E | Repairs | 1 | - |

| 337 | E | Supplies | 1 | - |

| 338 | E | Taxes | 1 | - |

| 339 | E | Utilities | 1 | - |

| 340 | E | Wages paid | 1 | - |

| 502 | E | Management fees | 1 | - |

| 342 | E | Kind/location of property | 2 | N/A |

| 341 | E | Other expenses | 3 | - |