Tax1095C_V100

OFX / Types / Tax1095C_V100

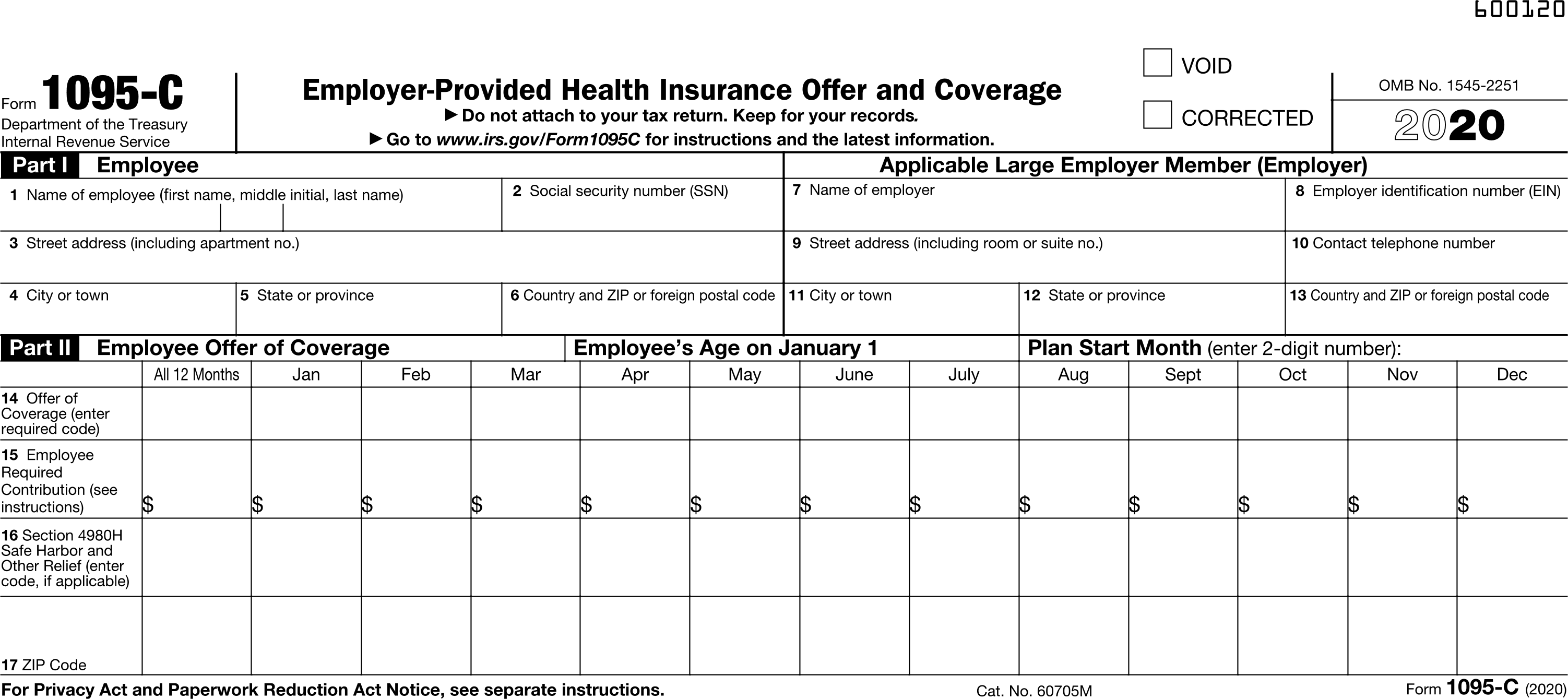

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | ALECONTACTPHONE | PhoneType |

| 6 | EMPLOYER | Employer |

| 7 | EMPLOYEEINFO | EmployeeInfo |

| 8 | EMPLOYEEAGE | AgeType |

| 9 | PLANSTARTMONTH | anonymous simple type |

| 10 | ANNUALCOVERAGE | anonymous complex type |

| 11 | MONTHLYCOVERAGE | PartIIGrpType |

| 12 | SELFINSURED | BooleanType |

| 13 | COVEREDINDIVIDUAL | CoveredIndivGrpType |

Usages:

- Tax1095Response TAX1095C_V100

XSD

<xsd:complexType name="Tax1095C_V100"> <xsd:annotation> <xsd:documentation>The OFX element "TAX1095C_V100" is of type "Tax1095C_V100"</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:AbstractTaxForm1095"> <xsd:sequence> <xsd:element name="ALECONTACTPHONE" type="ofx:PhoneType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Contact telphone number</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="EMPLOYER" type="ofx:Employer" minOccurs="0"/> <xsd:element name="EMPLOYEEINFO" type="ofx:EmployeeInfo" minOccurs="0"/> <xsd:element name="EMPLOYEEAGE" type="ofx:AgeType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Employee's Age on January 1. New TY20</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PLANSTARTMONTH" minOccurs="0"> <xsd:annotation> <xsd:documentation>Optional for TY15. Enter the 2 digit month 01-12</xsd:documentation> </xsd:annotation> <xsd:simpleType> <xsd:restriction base="xsd:string"> <xsd:enumeration value="01"/> <xsd:enumeration value="02"/> <xsd:enumeration value="03"/> <xsd:enumeration value="04"/> <xsd:enumeration value="05"/> <xsd:enumeration value="06"/> <xsd:enumeration value="07"/> <xsd:enumeration value="08"/> <xsd:enumeration value="09"/> <xsd:enumeration value="10"/> <xsd:enumeration value="11"/> <xsd:enumeration value="12"/> </xsd:restriction> </xsd:simpleType> </xsd:element> <xsd:choice> <xsd:element name="ANNUALCOVERAGE" minOccurs="0"> <xsd:annotation> <xsd:documentation>Use if Covered for ALL 12 Months</xsd:documentation> </xsd:annotation> <xsd:complexType> <xsd:sequence> <xsd:element name="COVERAGEOFFERCD"> <xsd:simpleType> <xsd:restriction base="xsd:string"> <xsd:maxLength value="2"/> <xsd:minLength value="2"/> </xsd:restriction> </xsd:simpleType> </xsd:element> <xsd:element name="MONTHLYPREMIUMAMT" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>If COVERAGEOFFERCD is 1B,1C,1D, 1E</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="SEC4980HCODE" minOccurs="0"> <xsd:simpleType> <xsd:restriction base="xsd:string"> <xsd:maxLength value="2"/> </xsd:restriction> </xsd:simpleType> </xsd:element> <xsd:element name="POSTALCODE" type="ofx:ZipType" minOccurs="0"> <xsd:annotation> <xsd:documentation>ZIP Code. New TY20</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:complexType> </xsd:element> <xsd:element name="MONTHLYCOVERAGE" type="ofx:PartIIGrpType" minOccurs="0" maxOccurs="unbounded"> <xsd:annotation> <xsd:documentation>Use if NOT covered for ALL 12 months</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:choice> <xsd:element name="SELFINSURED" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Checked if employer provided self-insured coverage</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="COVEREDINDIVIDUAL" type="ofx:CoveredIndivGrpType" minOccurs="0" maxOccurs="unbounded"/> </xsd:sequence> </xsd:extension> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1095MSGSRSV1>

<TAX1095TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1095RS>

<TAX1095C_V100>

<SRVRTID>e5d4ee73bd1-9295-480f-a426-1095-C</SRVRTID>

<TAXYEAR>2020</TAXYEAR>

<ALECONTACTPHONE>888-555-1212</ALECONTACTPHONE>

<EMPLOYER>

<FEDIDNUMBER>12-3456789</FEDIDNUMBER>

<NAME1>Financial Data Exchange</NAME1>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

</EMPLOYER>

<EMPLOYEEINFO>

<SSN>xxx-xx-1234</SSN>

<NAME>Kris Q Public</NAME>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

<COUNTRYSTRING>US</COUNTRYSTRING>

</EMPLOYEEINFO>

<EMPLOYEEAGE>25</EMPLOYEEAGE>

<PLANSTARTMONTH>11</PLANSTARTMONTH>

<ANNUALCOVERAGE>

<COVERAGEOFFERCD>1E</COVERAGEOFFERCD>

<MONTHLYPREMIUMAMT>30.18</MONTHLYPREMIUMAMT>

<SEC4980HCODE>2C</SEC4980HCODE>

<POSTALCODE>12121</POSTALCODE>

</ANNUALCOVERAGE>

<MONTHLYCOVERAGE>

<MONTHNAME>NOV</MONTHNAME>

<COVERAGEOFFERCD>1E</COVERAGEOFFERCD>

<MONTHLYPREMIUMAMT>15.09</MONTHLYPREMIUMAMT>

<SEC4980HCODE>2C</SEC4980HCODE>

<POSTALCODE>12121</POSTALCODE>

</MONTHLYCOVERAGE>

<MONTHLYCOVERAGE>

<MONTHNAME>DEC</MONTHNAME>

<COVERAGEOFFERCD>1E</COVERAGEOFFERCD>

<MONTHLYPREMIUMAMT>15.09</MONTHLYPREMIUMAMT>

<SEC4980HCODE>2C</SEC4980HCODE>

<POSTALCODE>12121</POSTALCODE>

</MONTHLYCOVERAGE>

<SELFINSURED>N</SELFINSURED>

<COVEREDINDIVIDUAL>

<PERSONNM>Kris Q Public</PERSONNM>

<SSN>xxx-xx-1234</SSN>

<PERSONBIRTHDT>19950711</PERSONBIRTHDT>

<ALLYEARIND>Y</ALLYEARIND>

<NOVEMBERIND>Y</NOVEMBERIND>

<DECEMBERIND>Y</DECEMBERIND>

</COVEREDINDIVIDUAL>

<COVEREDINDIVIDUAL>

<PERSONNM>Tracy R Public</PERSONNM>

<SSN>xxx-xx-4321</SSN>

<PERSONBIRTHDT>19950811</PERSONBIRTHDT>

<ALLYEARIND>Y</ALLYEARIND>

<NOVEMBERIND>Y</NOVEMBERIND>

<DECEMBERIND>Y</DECEMBERIND>

</COVEREDINDIVIDUAL>

</TAX1095C_V100>

</TAX1095RS>

</TAX1095TRNRS>

</TAX1095MSGSRSV1>

</OFX>

FDX JSON

{

"tax1095C" : {

"taxYear" : 2022,

"taxFormId" : "e5d4ee73bd1-9295-480f-a426-1095-C",

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1095C",

"employeeName" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"tin" : "xxx-xx-1234",

"employeeAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US"

},

"employerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"employerTin" : "12-3456789",

"selfInsuredCoverage" : false,

"offersOfCoverage" : [ {

"coverageCode" : "1E",

"requiredContribution" : 15.09,

"section4980HCode" : "2C",

"postalCode" : "12121",

"month" : "NOVEMBER"

}, {

"coverageCode" : "1E",

"requiredContribution" : 15.09,

"section4980HCode" : "2C",

"postalCode" : "12121",

"month" : "DECEMBER"

}, {

"coverageCode" : "1E",

"requiredContribution" : 30.18,

"section4980HCode" : "2C",

"postalCode" : "12121",

"month" : "ANNUAL"

} ],

"employeeAge" : 25,

"planStartMonth" : 11,

"coveredIndividuals" : [ {

"name" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"tin" : "xxx-xx-1234",

"dateOfBirth" : "1995-07-11",

"coveredAll12Months" : true,

"coveredMonths" : [ "NOV", "DEC" ]

}, {

"name" : {

"first" : "Tracy",

"middle" : "R",

"last" : "Public"

},

"tin" : "xxx-xx-4321",

"dateOfBirth" : "1995-08-11",

"coveredAll12Months" : true,

"coveredMonths" : [ "NOV", "DEC" ]

} ]

}

}