3922 : Transfer of Stock Acquired Through an Employee Stock Purchase Plan under Section 423(c)

FDX

FDX / Data Structures / Tax3922

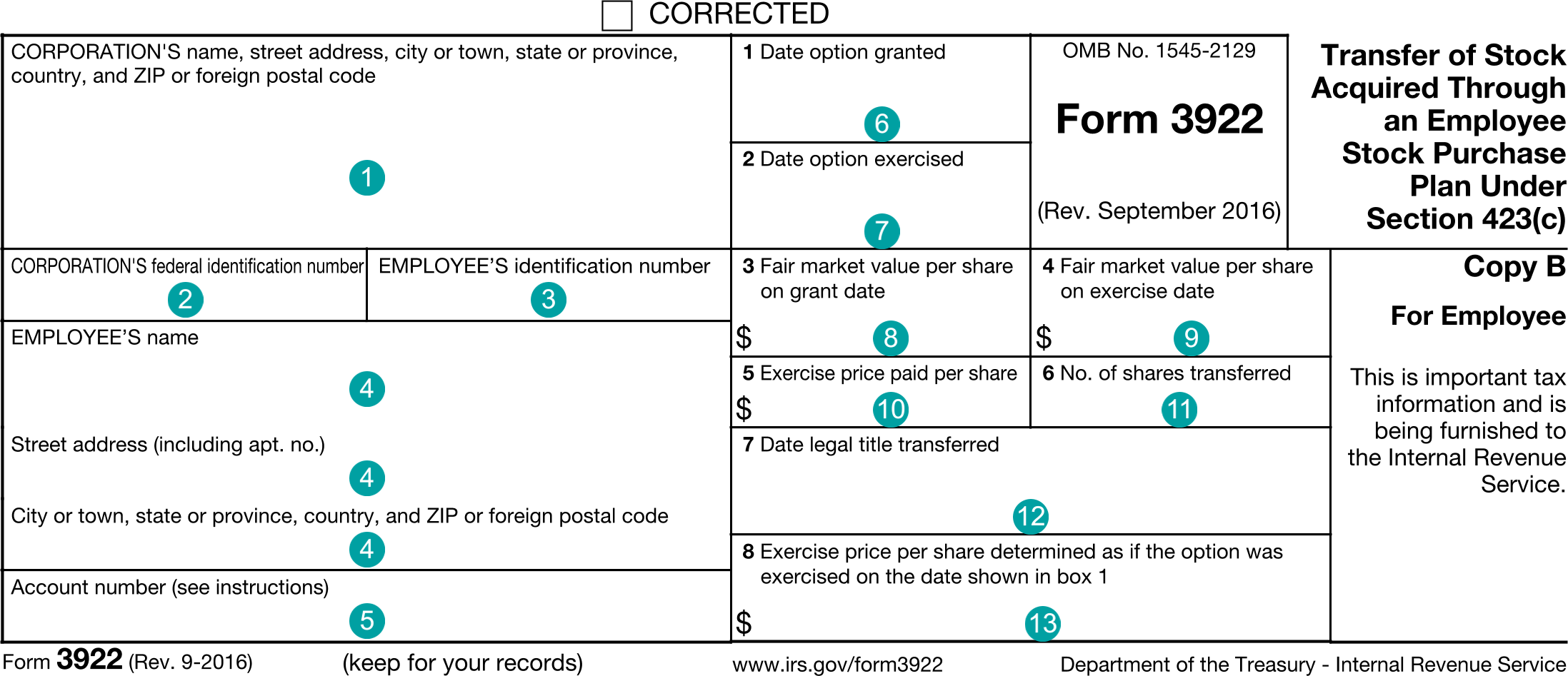

Form 3922, Transfer of Stock Acquired Through an Employee Stock Purchase Plan under Section 423(c)

Extends and inherits all fields from Tax

Tax3922 Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | corporationNameAddress | NameAddress | CORPORATION'S name, street address, city or town, state or province, country and ZIP or foreign postal code |

| 2 | corporationTin | string | CORPORATION'S TIN |

| 3 | employeeTin | string | EMPLOYEE'S TIN |

| 4 | employeeNameAddress | NameAddress | EMPLOYEE'S name, street address (including apt. no.), city or town, state or province, country and ZIP or foreign postal code |

| 5 | accountNumber | string | Account number |

| 6 | optionGrantDate | DateString | Box 1, Date option granted |

| 7 | optionExerciseDate | DateString | Box 2, Date option exercised |

| 8 | grantMarketValue | number (double) | Box 3, Fair market value per share on grant date |

| 9 | exerciseMarketValue | number (double) | Box 4, Fair market value per share on exercise date |

| 10 | exercisePrice | number (double) | Box 5, Exercise price paid per share |

| 11 | numberOfShares | number (double) | Box 6, Number of shares transferred |

| 12 | titleTransferDate | DateString | Box 7, Date legal title transferred |

| 13 | grantDateExercisePrice | number (double) | Box 8, Exercise price per share determined as if the option was exercised on the option granted date |

Tax3922 Usage:

- TaxData tax3922

OFX

The OFX standard does not support this form.

FIRE

Under Development

TXF

The TXF standard does not support this form.