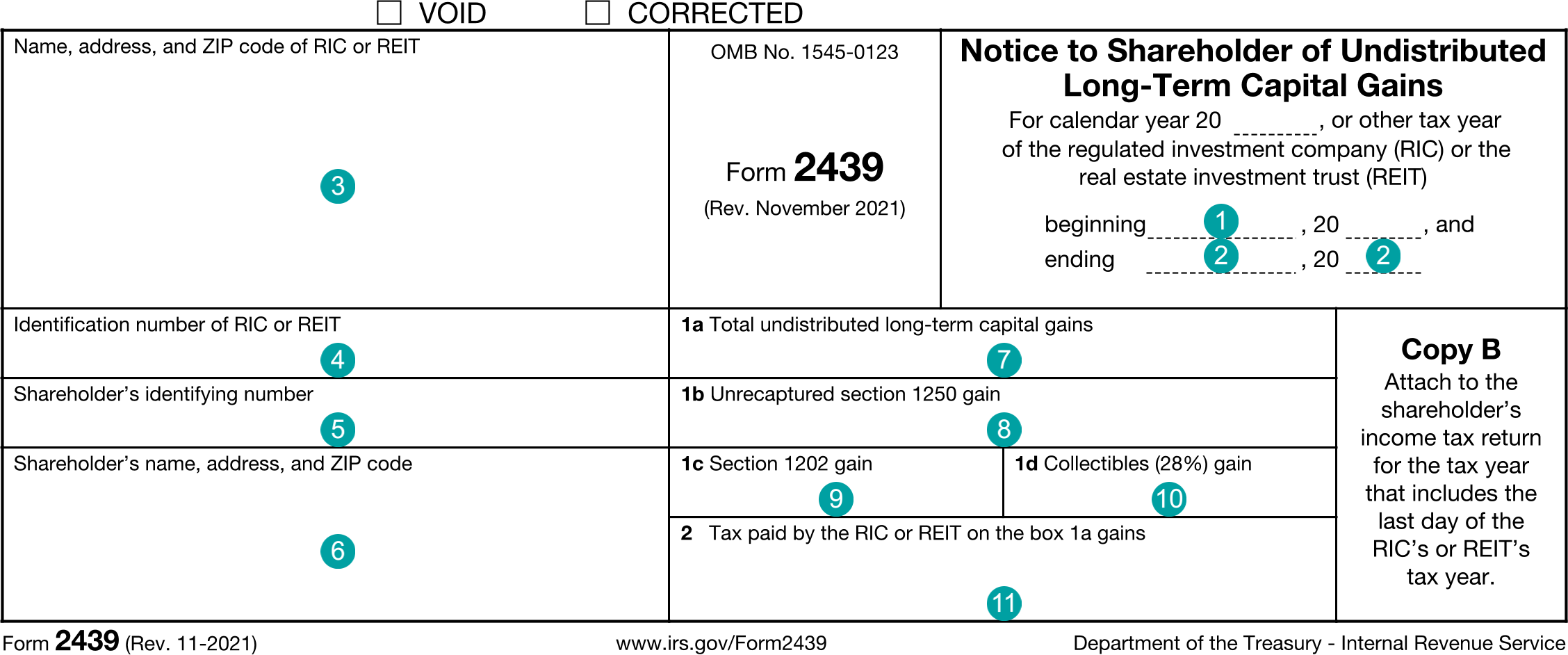

2439 : Notice to Shareholder of Undistributed Long-Term Capital Gains

FDX

FDX / Data Structures / Tax2439

Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains

Extends and inherits all fields from Tax

Tax2439 Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | fiscalYearBegin | DateString | Fiscal year begin date |

| 2 | fiscalYearEnd | DateString | Fiscal year end date |

| 3 | ricOrReitNameAddress | NameAddressPhone | RIC or REIT's name, address and phone |

| 4 | ricOrReitTin | string | Identification number of RIC or REIT |

| 5 | shareholderNameAddress | NameAddress | Shareholder's address |

| 6 | shareholderTin | string | Shareholder's identifying number |

| 7 | undistributedLongTermCapitalGains | number (double) | Box 1a, Total undistributed long-term capital gains |

| 8 | unrecaptured1250Gain | number (double) | Box 1b, Unrecaptured section 1250 gain |

| 9 | section1202Gain | number (double) | Box 1c, Section 1202 gain |

| 10 | collectiblesGain | number (double) | Box 1d, Collectibles (28%) gain |

| 11 | taxPaid | number (double) | Box 2, Tax paid by the RIC or REIT on the box 1a gains |

Tax2439 Usage:

- TaxData tax2439

OFX

OFX / Types / Tax2439_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | FISCALYEARBEGIN | DateTimeType |

| 6 | FISCALYEAREND | DateTimeType |

| 7 | RICREITADDR | Corporation2439AddressType |

| 8 | SHAREHOLDERADDR | Shareholder2439AddressType |

| 9 | RICREITID | GenericNameType |

| 10 | SHAREHOLDERID | IdType |

| 11 | UNDISTLTCG | AmountType |

| 12 | UNRECAP1250 | AmountType |

| 13 | SEC1202GAIN | AmountType |

| 14 | COLLECTIBLESGAIN | AmountType |

| 15 | TAXPAID | AmountType |

Usages:

- Tax2439Response TAX2439_V100

FIRE

This form is not reported in the IRS FIRE system.

TXF

The TXF standard does not support this form.