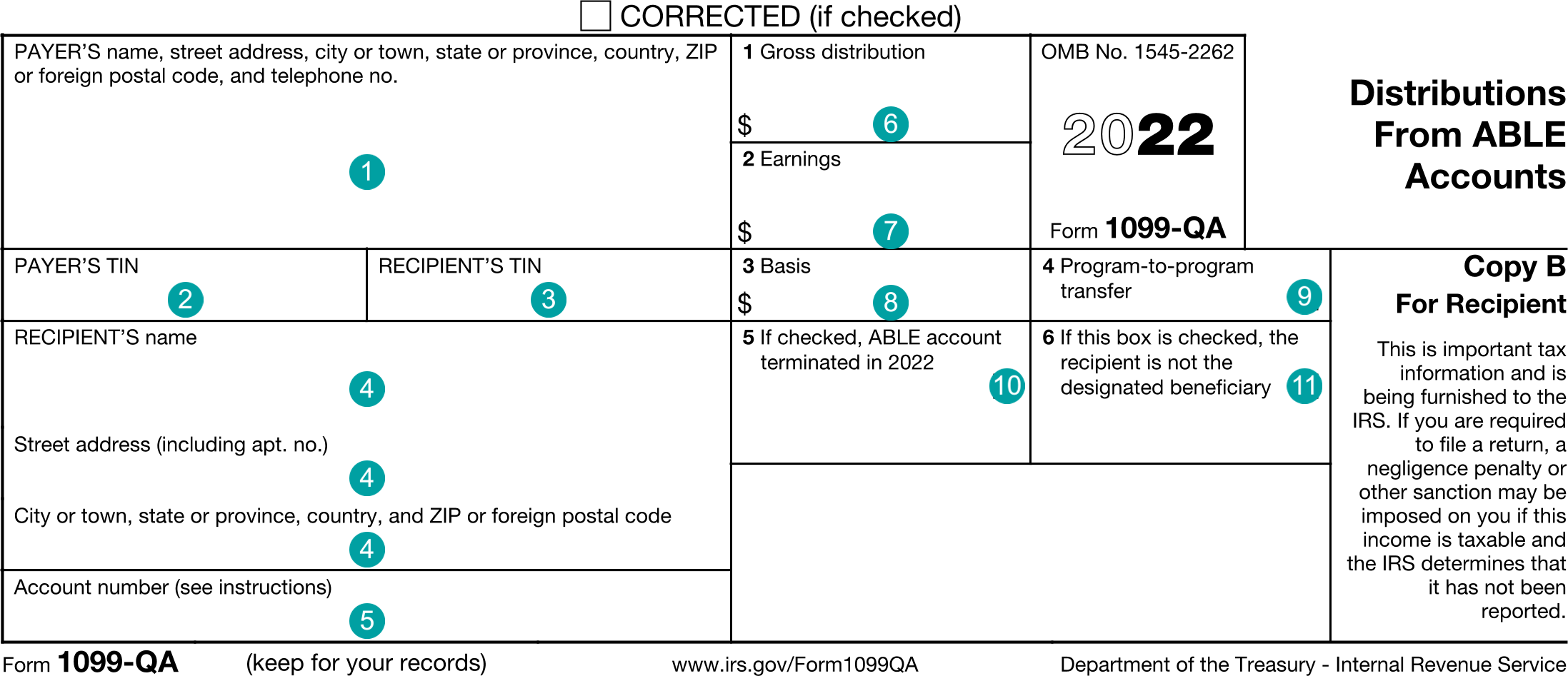

1099-QA : Distributions From ABLE Accounts

FDX

FDX / Data Structures / Tax1099Qa

Form 1099-QA, Distributions From ABLE Accounts

Extends and inherits all fields from Tax

Tax1099Qa Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name, street address, city or town, state or province, country, and ZIP or foreign postal code |

| 5 | accountNumber | string | Account number |

| 6 | grossDistribution | number (double) | Box 1, Gross distribution |

| 7 | earnings | number (double) | Box 2, Earnings |

| 8 | basis | number (double) | Box 3, Basis |

| 9 | programTransfer | boolean | Box 4, Program-to-program transfer |

| 10 | terminated | boolean | Box 5, Check if ABLE account terminated in current year |

| 11 | notBeneficiary | boolean | Box 6, Check if the recipient is not the designated beneficiary |

Tax1099Qa Usage:

- TaxData tax1099Qa

OFX

The OFX standard does not support this form.

FIRE

This form is not reported in the IRS FIRE system.

TXF

The TXF standard does not support this form.