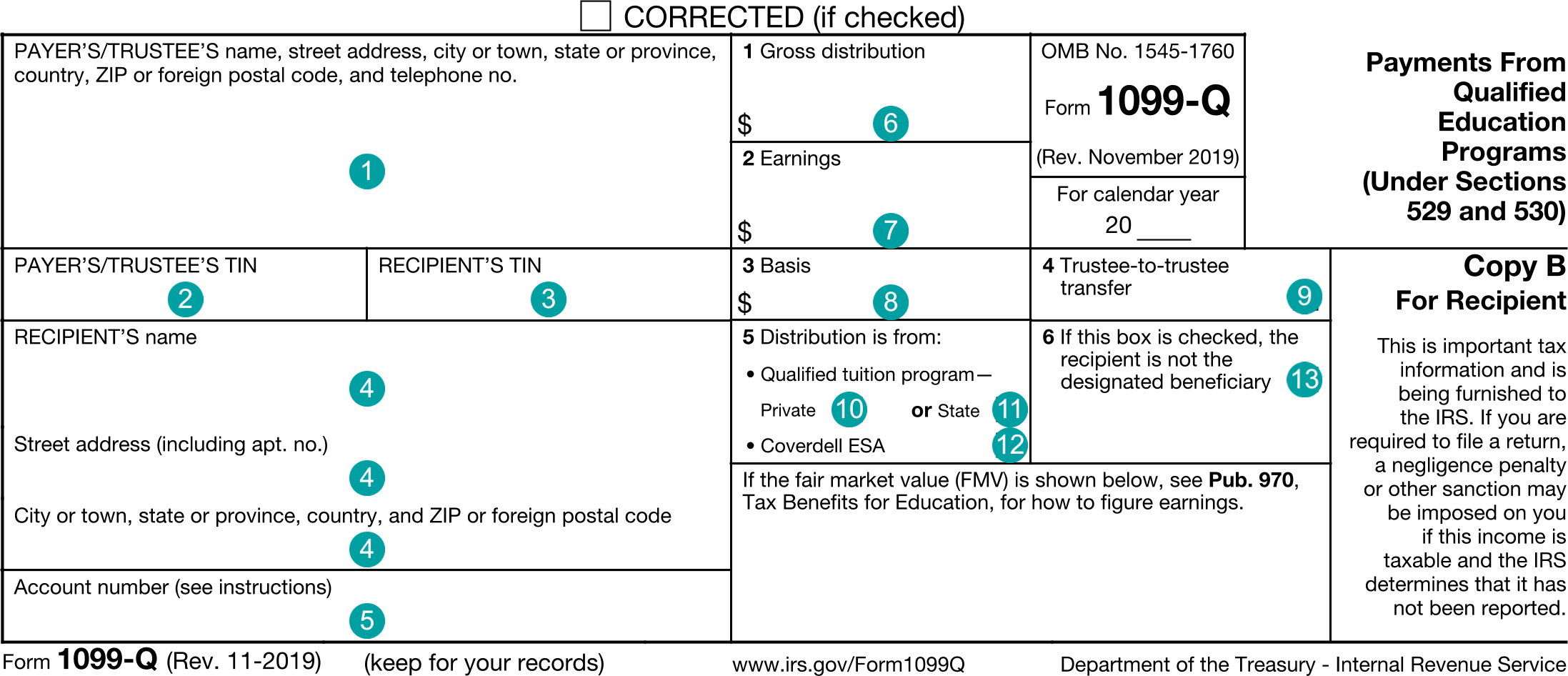

1099-Q : Payments From Qualified Education Programs

FDX

FDX / Data Structures / Tax1099Q

Form 1099-Q, Payments From Qualified Education Programs

Extends and inherits all fields from Tax

Tax1099Q Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | PAYER'S/TRUSTEE'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | accountNumber | string | Account number |

| 6 | grossDistribution | number (double) | Box 1, Gross distribution |

| 7 | earnings | number (double) | Box 2, Earnings |

| 8 | basis | number (double) | Box 3, Basis |

| 9 | trusteeToTrustee | boolean | Box 4, Trustee-to-trustee transfer |

| 10 | tuitionPlanPrivate | boolean | Box 5a, Qualified tuition plan - Private |

| 11 | tuitionPlanPublic | boolean | Box 5b, Qualified tuition plan - Public |

| 12 | coverdellEsa | boolean | Box 5c, Coverdell ESA |

| 13 | recipientIsNotBeneficiary | boolean | Box 6, If this box is checked, the recipient is not the designated beneficiary |

Tax1099Q Usage:

- TaxData tax1099Q

OFX

OFX / Types / Tax1099Q_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | PAYERADDR | PayerAddressType |

| 6 | RECIPADDR | RecipientAddressType |

| 7 | PAYERID | GenericNameType |

| 8 | RECID | IdType |

| 9 | ACCTNUM | GenericNameType |

| 10 | GROSSDISTRIB | AmountType |

| 11 | EARNINGS | AmountType |

| 12 | BASIS | AmountType |

| 13 | TRUSTEE | BooleanType |

| 14 | NOTBENEFICIARY | BooleanType |

| 15 | QTPPRIV | BooleanType |

| 16 | QTPPUBLIC | BooleanType |

| 17 | COVERDELL | BooleanType |

Usages:

- Tax1099Response TAX1099Q_V100

FIRE

Under Development

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 672 | 1099-Q | Gross distribution | 1 | + |

| 678 | 1099-Q | 1099 Q | 1 | + |