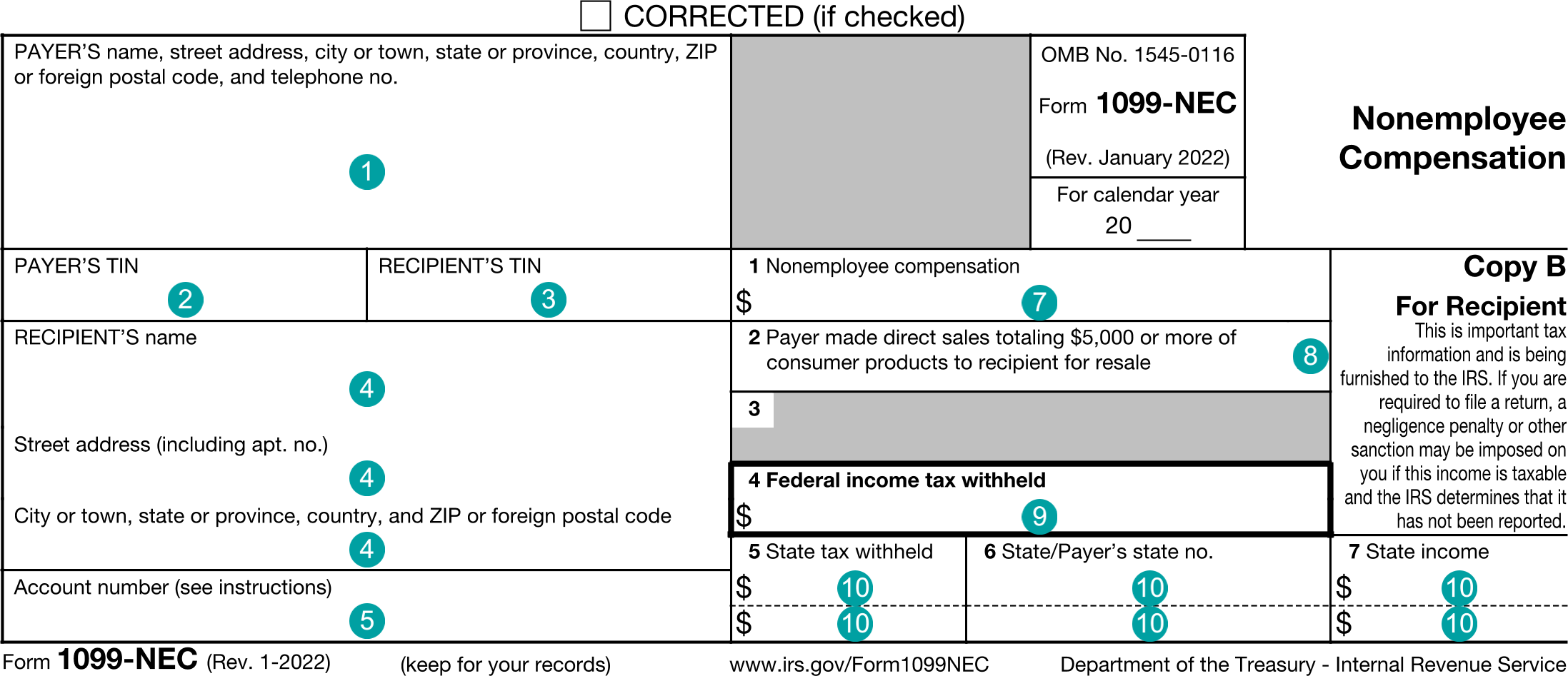

1099-NEC : Nonemployee Compensation

FDX

FDX / Data Structures / Tax1099Nec

Form 1099-NEC, Non-Employee Compensation

Extends and inherits all fields from Tax

Tax1099Nec Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | payerNameAddress | NameAddressPhone | PAYER'S name, address, and phone |

| 2 | payerTin | string | PAYER'S TIN |

| 3 | recipientTin | string | RECIPIENT'S TIN |

| 4 | recipientNameAddress | NameAddress | RECIPIENT'S name and address |

| 5 | accountNumber | string | Account number |

| 6 | secondTinNotice | boolean | Second TIN Notice |

| 7 | nonEmployeeCompensation | number (double) | Box 1, Nonemployee compensation |

| 8 | payerDirectSales | boolean | Box 2, Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale |

| 9 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 10 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 5-7, State tax withholding |

Tax1099Nec Usage:

- TaxData tax1099Nec

OFX

OFX / Types / Tax1099NEC_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | NONEMPCOMP | AmountType |

| 6 | FEDTAXWH | AmountType |

| 7 | STTAXWH | AmountType |

| 8 | PAYERSTATE | StateCodeType |

| 9 | PAYERSTID | IdType |

| 10 | STINCOME | AmountType |

| 11 | ADDLSTTAXWHAGG | AdditionalStateTaxWithheldAggregate |

| 12 | PAYERADDR | PayerAddress |

| 13 | PAYERID | GenericNameType |

| 14 | RECADDR | RecipientAddress |

| 15 | RECID | IdType |

| 16 | RECACCT | GenericNameType |

| 17 | TINNOT | BooleanType |

| 18 | FATCA | BooleanType |

Usages:

- Tax1099Response TAX1099NEC_V100

FIRE

Under Development

TXF

The TXF standard does not support this form.