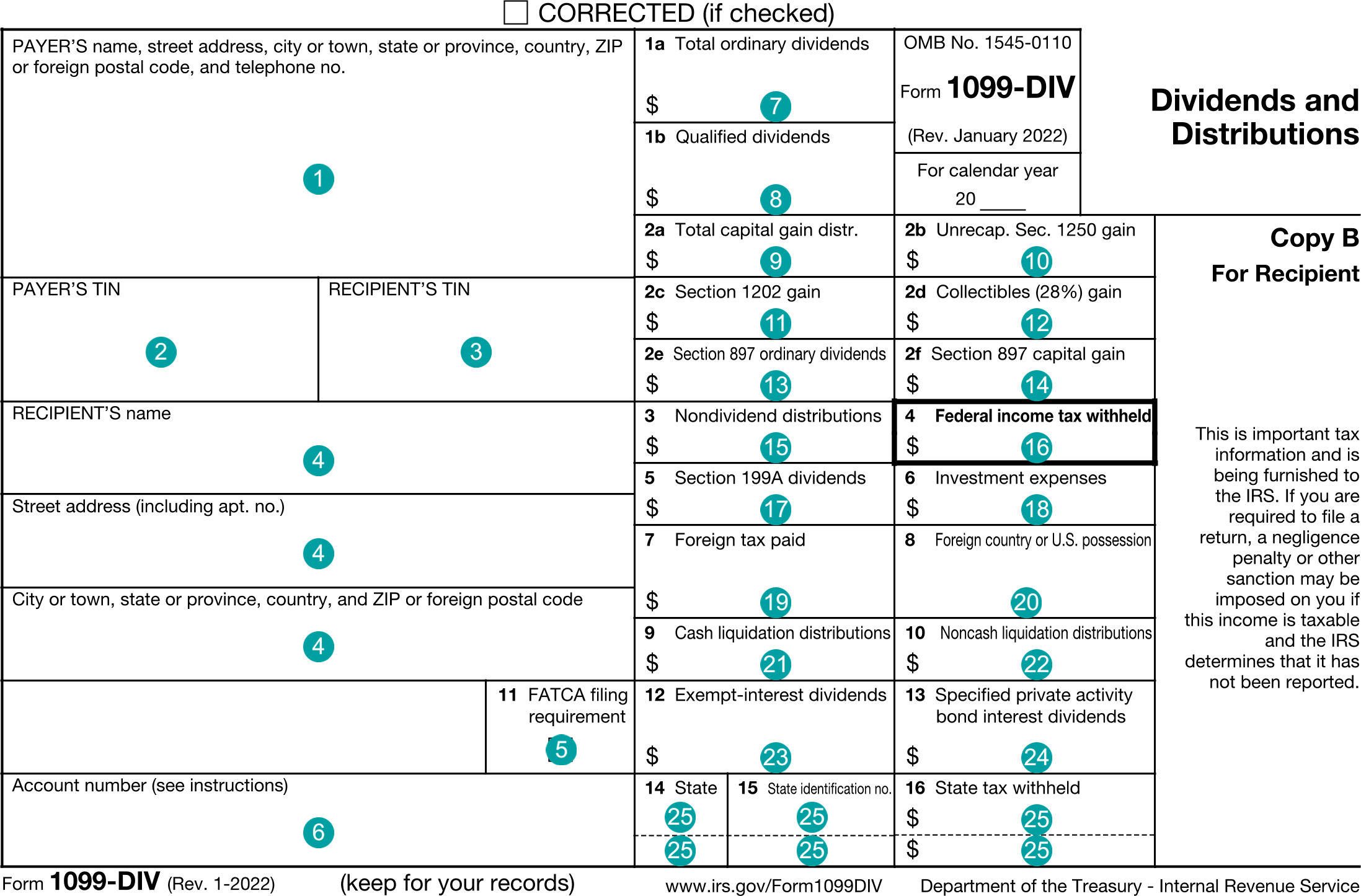

| # | Id | Type | Description |

| 1 | payerNameAddress | NameAddressPhone | Payer's name, address, and phone |

| 2 | payerTin | string | Payer's TIN |

| 3 | recipientTin | string | Recipient's TIN |

| 4 | recipientNameAddress | NameAddress | Recipient's name and address |

| 5 | foreignAccountTaxCompliance | boolean | FATCA filing requirement |

| 6 | accountNumber | string | Account number |

| 7 | ordinaryDividends | number (double) | Box 1a, Total ordinary dividends |

| 8 | qualifiedDividends | number (double) | Box 1b, Qualified dividends |

| 9 | totalCapitalGain | number (double) | Box 2a, Total capital gain distributions |

| 10 | unrecaptured1250Gain | number (double) | Box 2b, Unrecaptured Section 1250 gain |

| 11 | section1202Gain | number (double) | Box 2c, Section 1202 gain |

| 12 | collectiblesGain | number (double) | Box 2d, Collectibles (28%) gain |

| 13 | section897Dividends | number (double) | Box 2e, Section 897 ordinary dividends |

| 14 | section897CapitalGain | number (double) | Box 2f, Section 897 capital gain |

| 15 | nonTaxableDistribution | number (double) | Box 3, Nondividend distributions |

| 16 | federalTaxWithheld | number (double) | Box 4, Federal income tax withheld |

| 17 | section199ADividends | number (double) | Box 5, Section 199A dividends |

| 18 | investmentExpenses | number (double) | Box 6, Investment expenses |

| 19 | foreignTaxPaid | number (double) | Box 7, Foreign tax paid |

| 20 | foreignCountry | string | Box 8, Foreign country or U.S. possession |

| 21 | cashLiquidation | number (double) | Box 9, Cash liquidation distributions |

| 22 | nonCashLiquidation | number (double) | Box 10, Noncash liquidation distributions |

| 23 | taxExemptInterestDividend | number (double) | Box 11, Exempt-interest dividends |

| 24 | specifiedPabInterestDividend | number (double) | Box 12, Specified private activity bond interest dividends |

| 25 | stateTaxWithholding | Array of StateTaxWithholding | Boxes 13-15, State tax withholding |

| 26 | foreignIncomes | Array of DescriptionAmount | Foreign income information |

| 27 | stateTaxExemptIncomes | Array of DescriptionAmount | Tax exempt income state information |

| 28 | secondTinNotice | boolean | Second TIN Notice |