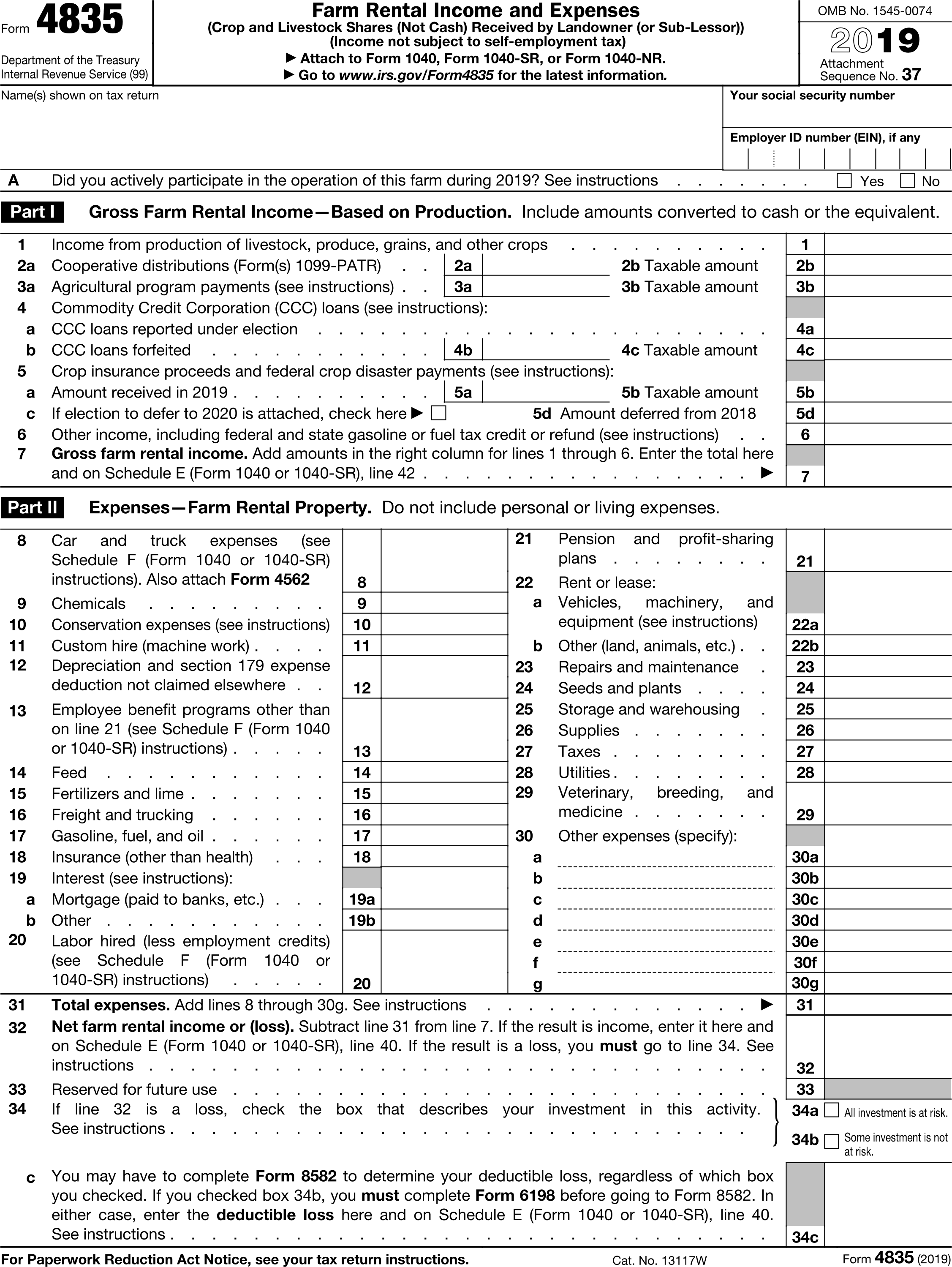

Farm Rental Income Statement : Farm Rental Income Statement for IRS Form 4835

FDX/QR

FDX / Data Structures / FarmRentalIncomeStatement

Farm Rental Income Statement, Farm Rental Income Statement for IRS Form 4835

Extends and inherits all fields from Tax

FarmRentalIncomeStatement Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | incomeFromProduction | number (double) | Box 1, Income from production of livestock, produce, grains, and other crops |

| 2 | coopDistributions | number (double) | Box 2a, Cooperative distributions |

| 3 | agProgramPayments | number (double) | Box 3a, Agricultural program payments |

| 4 | cccLoans | number (double) | Box 4a, Commodity Credit Corporation (CCC) loans reported under election |

| 5 | cropInsuranceProceeds | number (double) | Box 5a, Crop insurance proceeds and federal crop disaster payments |

| 6 | otherIncome | Array of DescriptionAmount | Box 6, Other income |

| 7 | carAndTruck | number (double) | Box 8, Car and truck expenses |

| 8 | chemicals | number (double) | Box 9, Chemicals |

| 9 | conservation | number (double) | Box 10, Conservation expenses |

| 10 | customHireExpenses | number (double) | Box 11, Custom hire (machine work) |

| 11 | depreciation | number (double) | Box 12, Depreciation |

| 12 | employeeBenefitPrograms | number (double) | Box 13, Employee benefit programs |

| 13 | feed | number (double) | Box 14, Feed |

| 14 | fertilizers | number (double) | Box 15, Fertilizers and lime |

| 15 | freight | number (double) | Box 16, Freight and trucking |

| 16 | fuel | number (double) | Box 17, Gasoline, fuel, and oil |

| 17 | insurance | number (double) | Box 18, Insurance (other than health) |

| 18 | mortgageInterest | number (double) | Box 19a, Mortgage Interest |

| 19 | otherInterest | number (double) | Box 19b, Other interest |

| 20 | laborHired | number (double) | Box 20, Labor hired |

| 21 | pension | number (double) | Box 21, Pension and profit-sharing plans |

| 22 | equipmentRent | number (double) | Box 22a, Rent or lease: Vehicles, machinery, equipment |

| 23 | otherRent | number (double) | Box 22b, Rent or lease: Other |

| 24 | repairs | number (double) | Box 23, Repairs and maintenance |

| 25 | seeds | number (double) | Box 24, Seeds and plants |

| 26 | storage | number (double) | Box 25, Storage and warehousing |

| 27 | supplies | number (double) | Box 26, Supplies |

| 28 | taxes | number (double) | Box 27, Taxes |

| 29 | utilities | number (double) | Box 28, Utilities |

| 30 | veterinary | number (double) | Box 29, Veterinary, breeding, and medicine |

| 31 | otherExpenses | Array of DescriptionAmount | Box 30, Other expenses |

| 32 | capitalExpenditures | Array of DateAmount | Capital expenditures, for use in calculating Depreciation |

FarmRentalIncomeStatement Usage:

- TaxData farmRentalIncomeStatement

OFX

The OFX standard does not support this form.

FIRE

This form is not reported in the IRS FIRE system.

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 570 | 4835 | Spouse | 0 | N/A |

| 569 | 4835 | Form 4835 | 1 | + |

| 571 | 4835 | Sale of livestock/produce | 1 | + |

| 572 | 4835 | Total co-op distributions | 1 | + |

| 573 | 4835 | Agricultural program paymnts | 1 | + |

| 574 | 4835 | CCC loans reported/election | 1 | + |

| 575 | 4835 | CCC loans forfeited/repaid | 1 | + |

| 576 | 4835 | Crop ins. proceeds rec'd | 1 | + |

| 577 | 4835 | Crop ins. proceeds deferred | 1 | + |

| 578 | 4835 | Other income | 1 | + |

| 579 | 4835 | Car and truck expenses | 1 | - |

| 580 | 4835 | Chemicals | 1 | - |

| 581 | 4835 | Conservation expenses | 1 | - |

| 582 | 4835 | Custom hire (machine work) | 1 | - |

| 583 | 4835 | Employee benefit programs | 1 | - |

| 584 | 4835 | Feed purchased | 1 | - |

| 585 | 4835 | Fertilizers and lime | 1 | - |

| 586 | 4835 | Freight and trucking | 1 | - |

| 587 | 4835 | Gasoline, fuel, and oil | 1 | - |

| 588 | 4835 | Insurance(other than health) | 1 | - |

| 589 | 4835 | Interest expense, mortgage | 1 | - |

| 590 | 4835 | Interest expense, other | 1 | - |

| 591 | 4835 | Labor hired | 1 | - |

| 592 | 4835 | Pension/profit-sharing plans | 1 | - |

| 593 | 4835 | Rent/lease vehicles, equip. | 1 | - |

| 594 | 4835 | Rent/lease land, animals | 1 | - |

| 595 | 4835 | Repairs and maintenance | 1 | - |

| 596 | 4835 | Seeds and plants purchased | 1 | - |

| 597 | 4835 | Storage and warehousing | 1 | - |

| 598 | 4835 | Supplies purchased | 1 | - |

| 599 | 4835 | Taxes | 1 | - |

| 600 | 4835 | Utilities | 1 | - |

| 601 | 4835 | Vet, breeding, medicine | 1 | - |

| 602 | 4835 | Other expenses | 3 | - |