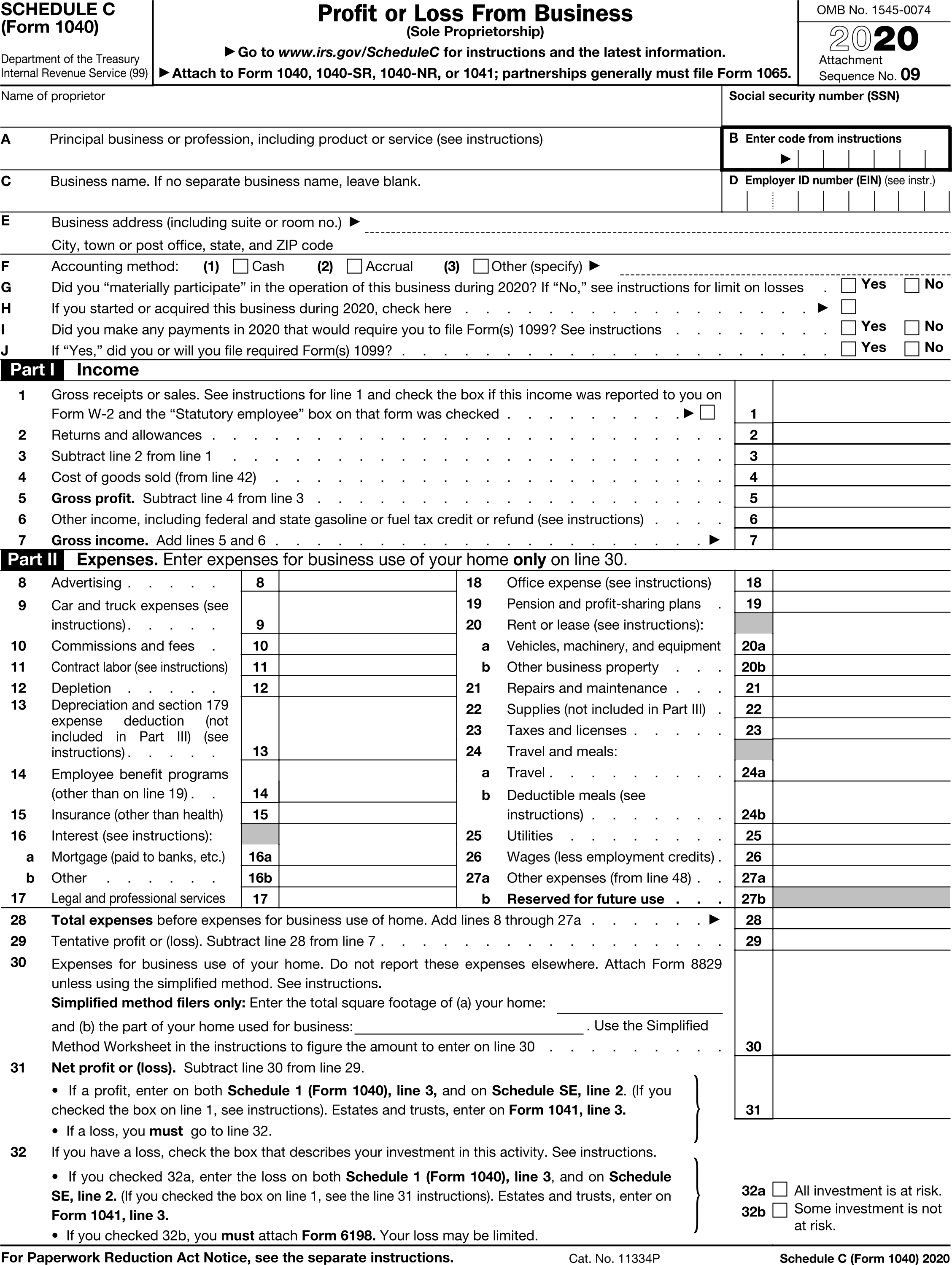

Business Income Statement : Business Income Statement for IRS Form 1040 Schedule C

FDX/QR

FDX / Data Structures / BusinessIncomeStatement

Business Income Statement, Business Income Statement for IRS Form 1040 Schedule C

Extends and inherits all fields from Tax

BusinessIncomeStatement Properties

| # | Id | Type | Description |

|---|---|---|---|

| 1 | businessName | string | Box C, Business name |

| 2 | sales | number (double) | Box 1, Gross receipts or sales |

| 3 | returns | number (double) | Box 2, Returns and allowances |

| 4 | otherIncome | Array of DescriptionAmount | Box 6, Other income, including federal and state gasoline or fuel tax credit or refund |

| 5 | advertising | number (double) | Box 8, Advertising |

| 6 | carAndTruck | number (double) | Box 9, Car and truck expenses |

| 7 | commissions | number (double) | Box 10, Commissions and fees |

| 8 | contractLabor | number (double) | Box 11, Contract labor |

| 9 | depletion | number (double) | Box 12, Depletion |

| 10 | depreciation | number (double) | Box 13, Depreciation |

| 11 | employeeBenefits | number (double) | Box 14, Employee benefit programs |

| 12 | insurance | number (double) | Box 15, Insurance |

| 13 | mortgageInterest | number (double) | Box 16a, Mortgage interest |

| 14 | otherInterest | number (double) | Box 16b, Other interest |

| 15 | legal | number (double) | Box 17, Legal and professional services |

| 16 | office | number (double) | Box 18, Office expense |

| 17 | pension | number (double) | Box 19, Pension and profit-sharing plans |

| 18 | equipmentRent | number (double) | Box 20a, Equipment rent |

| 19 | otherRent | number (double) | Box 20b, Other rent |

| 20 | repairs | number (double) | Box 21, Repairs and maintenance |

| 21 | supplies | number (double) | Box 22, Supplies |

| 22 | taxes | number (double) | Box 23, Taxes and licenses |

| 23 | travel | number (double) | Box 24a, Travel |

| 24 | meals | number (double) | Box 24b, Deductible meals |

| 25 | utilities | number (double) | Box 25, Utilities |

| 26 | wages | number (double) | Box 26, Wages |

| 27 | otherExpenses | Array of DescriptionAmount | Box 27, Other expenses |

| 28 | beginningInventory | number (double) | Box 35, Inventory at beginning of year |

| 29 | purchases | number (double) | Box 36, Purchases |

| 30 | costOfLabor | number (double) | Box 37, Cost of labor |

| 31 | materials | number (double) | Box 38, Materials and supplies |

| 32 | otherCosts | Array of DescriptionAmount | Box 39, Other costs |

| 33 | endingInventory | number (double) | Box 41, Inventory at end of year |

| 34 | capitalExpenditures | Array of DateAmount | Capital expenditures, for use in calculating Depreciation |

BusinessIncomeStatement Usage:

- TaxData businessIncomeStatement

OFX

The OFX standard does not support this form.

FIRE

This form is not reported in the IRS FIRE system.

TXF

| Reference Number | Irs Form or Schedule | Description | Record Format | Sign |

|---|---|---|---|---|

| 292 | C | Spouse | 0 | N/A |

| 291 | C | Schedule C | 1 | + |

| 293 | C | Gross receipts | 1 | + |

| 294 | C | Meals and entertainment | 1 | - |

| 295 | C | Cost of goods sold | 1 | - |

| 296 | C | Returns and allowances | 1 | - |

| 297 | C | Wages paid | 1 | - |

| 298 | C | Legal and professional | 1 | - |

| 299 | C | Rent on vehicles, mach, eq | 1 | - |

| 300 | C | Rent on other bus prop | 1 | - |

| 301 | C | Supplies | 1 | - |

| 303 | C | Other business income | 1 | + |

| 304 | C | Advertising | 1 | - |

| 305 | C | Bad debts | 1 | - |

| 306 | C | Car and truck expenses | 1 | - |

| 307 | C | Commissions and fees | 1 | - |

| 308 | C | Employee benefits progs. | 1 | - |

| 309 | C | Depletion | 1 | - |

| 310 | C | Insurance (not health) | 1 | - |

| 311 | C | Interest expense, mortgage | 1 | - |

| 312 | C | Interest expense, other | 1 | - |

| 313 | C | Office expense | 1 | - |

| 314 | C | Pension and profit shrg | 1 | - |

| 315 | C | Repairs and maintenance | 1 | - |

| 316 | C | Taxes and licenses | 1 | - |

| 317 | C | Travel | 1 | - |

| 318 | C | Utilities | 1 | - |

| 493 | C | Purchases, cost of goods | 1 | - |

| 494 | C | Labor, cost of goods sold | 1 | - |

| 495 | C | Materials, cost of goods | 1 | - |

| 496 | C | Other costs, cost of goods | 1 | - |

| 685 | C | Contract labor | 1 | - |

| 319 | C | Principal business/prof | 2 | N/A |

| 302 | C | Other business expense | 3 | - |