Tax5498ESA_V100

OFX / Types / Tax5498ESA_V100

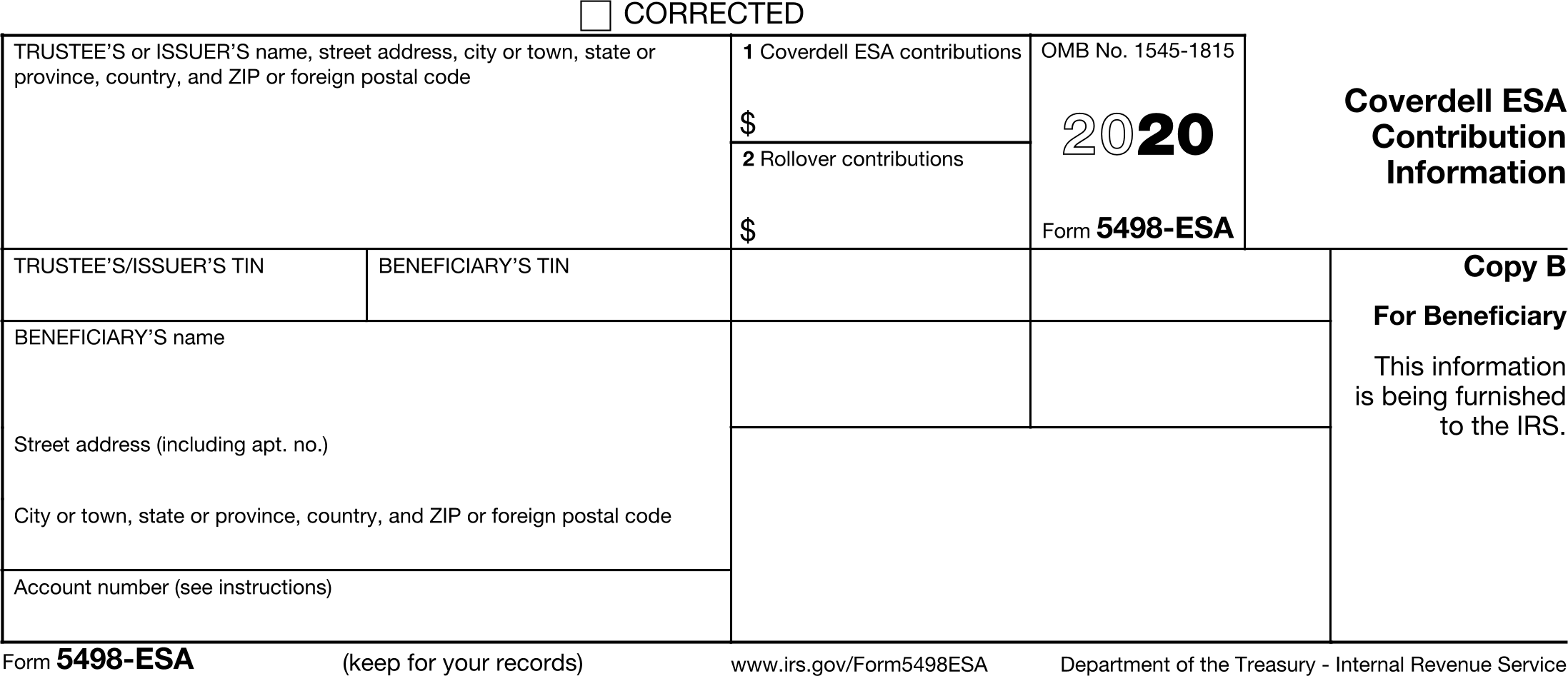

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | TRUSTEEADDR | TrusteeAddressType |

| 6 | BENEFICIARYADDR | BeneficiaryAddressType |

| 7 | TRUSTEEID | GenericNameType |

| 8 | BENEFICIARYID | IdType |

| 9 | ACCTNUM | GenericNameType |

| 10 | ESACONTRIB | AmountType |

| 11 | ROLLOVER | AmountType |

Usages:

- Tax5498Response TAX5498ESA_V100

XSD

<xsd:complexType name="Tax5498ESA_V100">

<xsd:annotation>

<xsd:documentation>Form 5498-ESA - Coverdell ESA Contribution Information</xsd:documentation>

</xsd:annotation>

<xsd:complexContent>

<xsd:extension base="ofx:AbstractTaxForm5498Type">

<xsd:sequence>

<xsd:element name="TRUSTEEADDR" type="ofx:TrusteeAddressType" minOccurs="0"/>

<xsd:element name="BENEFICIARYADDR" type="ofx:BeneficiaryAddressType" minOccurs="0"/>

<xsd:element name="TRUSTEEID" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>TRUSTEE’S/ISSUER’S federal identification no.</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="BENEFICIARYID" type="ofx:IdType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>BENEFICIARY'S social security number</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="ACCTNUM" type="ofx:GenericNameType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Account number</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="ESACONTRIB" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 1. Coverdell ESA contributions</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="ROLLOVER" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Box 2. Rollover contributions</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

</xsd:extension>

</xsd:complexContent>

</xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX5498MSGSRSV1>

<TAX5498TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX5498RS>

<TAX5498ESA_V100>

<TAXYEAR>2020</TAXYEAR>

<TRUSTEEADDR>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

<PHONE></PHONE>

<TRUSTEENAME1>Financial Data Exchange</TRUSTEENAME1>

</TRUSTEEADDR>

<BENEFICIARYADDR>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

<BENEFICIARYNAME1>Kris Q. Public</BENEFICIARYNAME1>

</BENEFICIARYADDR>

<TRUSTEEID>12-3456789</TRUSTEEID>

<BENEFICIARYID>XXX-XX-1234</BENEFICIARYID>

<ACCTNUM>123-1234567</ACCTNUM>

<ESACONTRIB>1000.00</ESACONTRIB>

<ROLLOVER>2000.00</ROLLOVER>

</TAX5498ESA_V100>

</TAX5498RS>

</TAX5498TRNRS>

</TAX5498MSGSRSV1>

</OFX>

FDX JSON

{

"tax5498Esa" : {

"taxYear" : 2021,

"taxFormDate" : "2022-03-30",

"additionalInformation" : "FDX v5.0",

"taxFormType" : "Tax5498Esa",

"issuerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"issuerTin" : "12-3456789",

"beneficiaryTin" : "XXX-XX-1234",

"beneficiaryNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"name1" : "Kris Q. Public"

},

"accountNumber" : "123-1234567",

"coverdellEsaContributions" : 1000.0,

"rolloverContributions" : 2000.0

}

}