Intelligent Tax Document®

Intelligent Tax Document Recipients

For taxpayers, this technology allows tedious and error-prone manual data entry to be replaced by simply dragging and dropping the document file into tax software applications.

Just:

1. Download the document from the issuer website.

2. Upload the PDF file to your tax software.

Tax Prep Software Developers

For tax prep software developers, OCR and PDF parsing are replaced by a simpler-to-implement and more reliable technology. Get more information.

Tax Document Software Developers

In as little as 24 hours or less of development, you can convert your tax documents into Intelligent Tax Documents®. Get more information.

What is an "Intelligent Tax Document"? — Technical Details

An Intelligent Tax Document® is a

(1) tax document

in

(2) portable document

format

(PDF) that

includes the document data in

(3) JavaScript Object Notation (JSON)

format

in the

(4) PDF document properties.

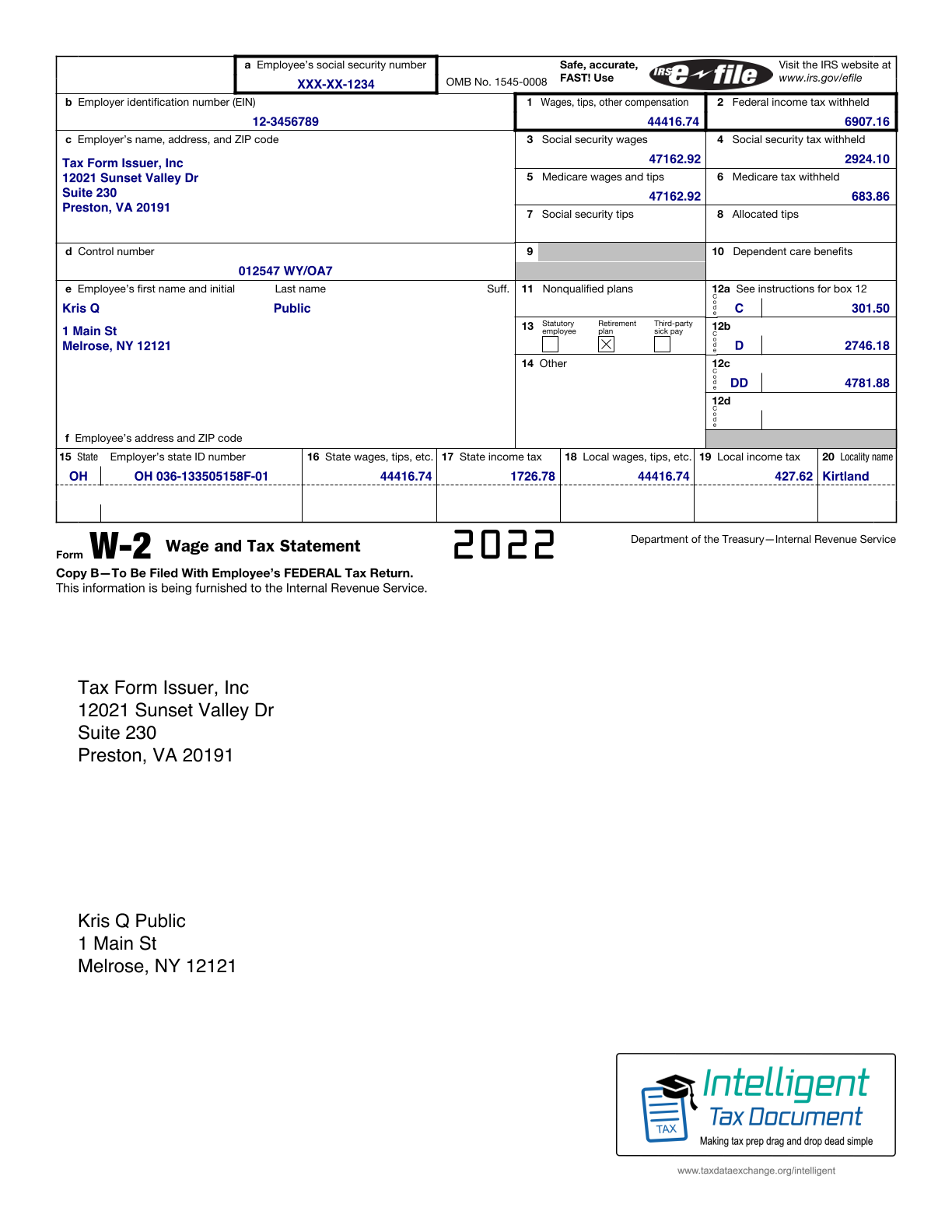

(1) TAX DOCUMENTS

Tax documents are forms and statements issued to a taxpayer by a third party that contain information used in the completion of the taxpayer's income tax return.

One physical tax document may contain more than one logical tax form or statement. For example, a broker may issue a consolidated tax statement that contains Forms 1099-B, 1099-DIV, 1099-INT, 1099-OID, and 1099-MISC.

FORMS

Common forms issued by third parties include:

- Form W-2, Wage and Tax Statement, issued to taxpayer by an employer

- Form 1099-B, Proceeds From Broker Transactions, issued to taxpayer by a stock broker

STATEMENTS

Statements issued by third parties include:

- Statement of rental income and expenses issued to taxpayer by a property manager

(2) PDF

The most common file format for downloadable tax documents. Such tax documents can be viewed using any application that can display PDF files. The most commonly used PDF viewer application is Adobe Acrobat Reader DC available at get.adobe.com/reader/.

Ordinary tax documents in PDF format are readable by humans. But they require either (1) manual data entry or (2) complex, costly-to-develop, and less-than-reliable parsing software to insert into tax software.

Intelligent tax documents® use a technology that is relatively simple to implement and highly reliable.

(3) JSON

A widely-used standard for data representation. Modern computer applications can readily consume data in JSON format.

Here is an example of JSON included in an intelligent tax document®:

{

"forms" : [ {

"taxW2" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "TaxW2",

"employeeTin" : "XXX-XX-1234",

"employerTin" : "12-3456789",

"employerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"name1" : "Tax Form Issuer, Inc"

},

"controlNumber" : "012547 WY/OA7",

"employeeName" : {

"first" : "Kris",

"middle" : "Q",

"last" : "Public"

},

"employeeAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121"

},

"wages" : 44416.74,

"federalTaxWithheld" : 6907.16,

"socialSecurityWages" : 47162.92,

"socialSecurityTaxWithheld" : 2924.1,

"medicareWages" : 47162.92,

"medicareTaxWithheld" : 683.86,

"codes" : [ {

"code" : "C",

"amount" : 301.5

}, {

"code" : "D",

"amount" : 2746.18

}, {

"code" : "DD",

"amount" : 4781.88

} ],

"retirementPlan" : true,

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 1726.78,

"state" : "OH",

"stateTaxId" : "OH 036-133505158F-01",

"stateIncome" : 44416.74

} ],

"localTaxWithholding" : [ {

"localTaxWithheld" : 427.62,

"localityName" : "Kirtland",

"state" : "OH",

"localIncome" : 44416.74

} ]

}

} ]

}

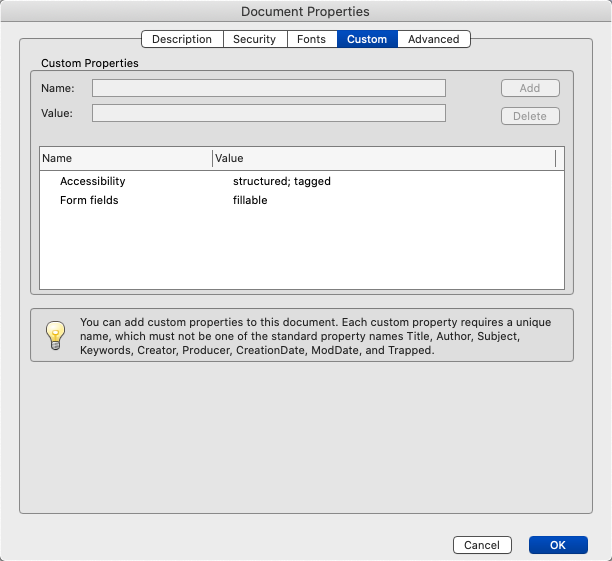

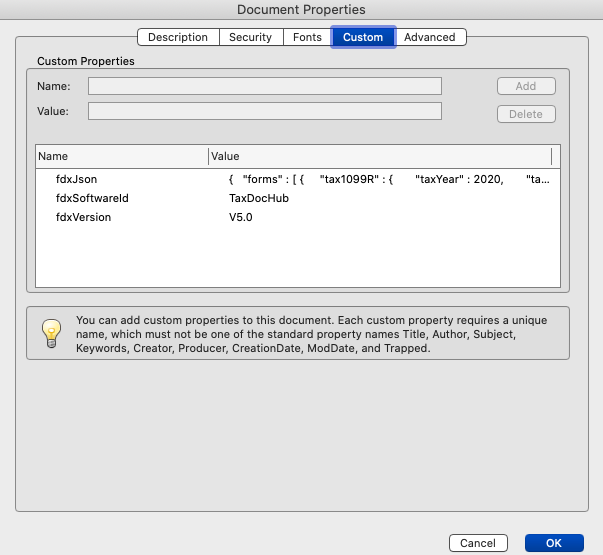

(4) PDF DOCUMENT PROPERTIES

PDF files may contain internal information known as document properties. Document properties are text values. A unique name is associated with each value.

INTELLIGENT TAX DOCUMENT® CUSTOM PROPERTIES

Intelligent tax documents® have 3 specific custom properties.

FDX SOFTWARE ID

The ID of the company or software application producing the PDF file.

FDX VERSION

The version number of the FDX schema used to create the FDX JSON.

FDX JSON

The Financial Data Exchange (FDX) organization establishes open standards for data structures of many tax documents. FDX JSON text can be readily consumed by computer applications such as tax software.