Tax1099K_V100

OFX / Types / Tax1099K_V100

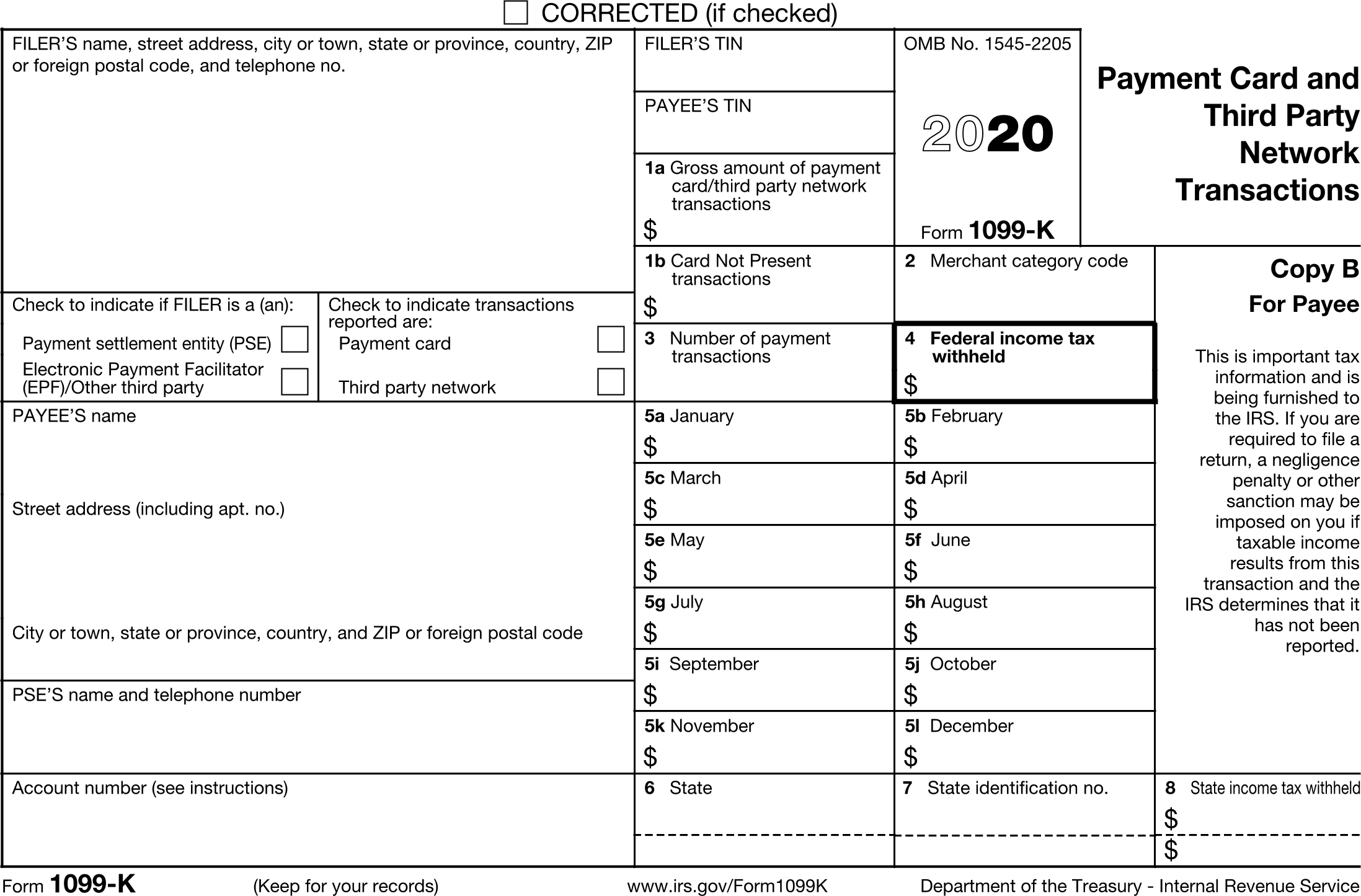

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | PAYEEADDR | PayeeAddressType |

| 6 | FILERADDR | FilerAddressType |

| 7 | ADDLSTATETAXWHAGG | AddlStateTaxWheldAggregateType |

| 8 | PSE | BooleanType |

| 9 | EPF | BooleanType |

| 10 | PAYCARD | BooleanType |

| 11 | THIRDNET | BooleanType |

| 12 | ACCTNUM | GenericNameType |

| 13 | FILERID | GenericNameType |

| 14 | PAYEEID | IdType |

| 15 | GROSS | AmountType |

| 16 | CARDNOTPRESENT | AmountType |

| 17 | CATCODE | GenericNameType |

| 18 | NUMTRAN | GenericNameType |

| 19 | FEDTAXWH | AmountType |

| 20 | JAN | AmountType |

| 21 | FEB | AmountType |

| 22 | MAR | AmountType |

| 23 | APR | AmountType |

| 24 | MAY | AmountType |

| 25 | JUN | AmountType |

| 26 | JUL | AmountType |

| 27 | AUG | AmountType |

| 28 | SEP | AmountType |

| 29 | OCT | AmountType |

| 30 | NOV | AmountType |

| 31 | DEC | AmountType |

| 32 | PSENAME | GenericNameType |

| 33 | PSEPHONE | PhoneType |

Usages:

- Tax1099Response TAX1099K_V100

XSD

<xsd:complexType name="Tax1099K_V100"> <xsd:annotation> <xsd:documentation>Form 1099-K - Merchant Card and Third-Party Network Payments</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:AbstractTaxForm1099Type"> <xsd:sequence> <xsd:element name="PAYEEADDR" type="ofx:PayeeAddressType" minOccurs="0"/> <xsd:element name="FILERADDR" type="ofx:FilerAddressType" minOccurs="0"/> <xsd:element name="ADDLSTATETAXWHAGG" type="ofx:AddlStateTaxWheldAggregateType" minOccurs="0" maxOccurs="unbounded"/> <xsd:element name="PSE" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Check to indicate if FILER is a (an): Payment settlement entity (PSE)</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="EPF" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Check to indicate if FILER is a (an): Electronic payment facilitator (EPF)/Other third party</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PAYCARD" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Check to indicate transactions reported are: Payment card</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="THIRDNET" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Check to indicate transactions reported are: Third party network</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="ACCTNUM" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Account number</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FILERID" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>FILER’S federal identification no.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PAYEEID" type="ofx:IdType" minOccurs="0"> <xsd:annotation> <xsd:documentation>PAYEE’S taxpayer identification no.</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="GROSS" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 1a. Gross amount of payment card/third party network transactions</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="CARDNOTPRESENT" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 1b. Card Not Present Transactions</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="CATCODE" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 2. Merchant category code</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="NUMTRAN" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 3. Number of purchase transactions</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FEDTAXWH" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 4. Federal income tax withheld</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="JAN" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5a. January</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FEB" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5b. February</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="MAR" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5c. March</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="APR" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5d. April</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="MAY" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5e. May</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="JUN" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5f. June</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="JUL" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5g. July</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="AUG" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5h. August</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="SEP" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5i. September</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="OCT" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5j. October</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="NOV" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5k. November</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="DEC" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5l. December</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PSENAME" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>PSE's name</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PSEPHONE" type="ofx:PhoneType" minOccurs="0"> <xsd:annotation> <xsd:documentation>PSE's phone number</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:extension> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099K_V100>

<TAXYEAR>2020</TAXYEAR>

<PAYEEADDR>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

<PAYEENAME1>Kris Q Public</PAYEENAME1>

</PAYEEADDR>

<FILERADDR>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

<PHONE>888-555-1212</PHONE>

<FILERNAME1>Financial Data Exchange</FILERNAME1>

</FILERADDR>

<ADDLSTATETAXWHAGG>

<STATECODE>NY</STATECODE>

<STATEIDNUM>123-1234</STATEIDNUM>

<STATETAXWHELD>10.00</STATETAXWHELD>

</ADDLSTATETAXWHAGG>

<PSE>Y</PSE>

<EPF>Y</EPF>

<PAYCARD>Y</PAYCARD>

<THIRDNET>Y</THIRDNET>

<ACCTNUM>111-5555555</ACCTNUM>

<FILERID>12-3456789</FILERID>

<PAYEEID>xxx-xx-0123</PAYEEID>

<GROSS>6000.00</GROSS>

<CARDNOTPRESENT>2000.00</CARDNOTPRESENT>

<CATCODE>1731</CATCODE>

<NUMTRAN>356.00</NUMTRAN>

<FEDTAXWH>400.00</FEDTAXWH>

<JAN>100.00</JAN>

<FEB>200.00</FEB>

<MAR>300.00</MAR>

<APR>400.00</APR>

<MAY>500.00</MAY>

<JUN>600.00</JUN>

<JUL>700.00</JUL>

<AUG>800.00</AUG>

<SEP>900.00</SEP>

<OCT>1000.00</OCT>

<NOV>1100.00</NOV>

<DEC>1200.00</DEC>

<PSENAME>PSE Associates</PSENAME>

<PSEPHONE></PSEPHONE>

</TAX1099K_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

FDX JSON

{

"tax1099K" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099K",

"filerNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"paymentSettlementEntity" : true,

"electronicPaymentFacilitator" : true,

"paymentCard" : true,

"thirdPartyNetwork" : true,

"payeeNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"pseName" : "PSE Associates",

"accountNumber" : "111-5555555",

"filerTin" : "12-3456789",

"payeeTin" : "xxx-xx-0123",

"grossAmount" : 6000.0,

"cardNotPresent" : 2000.0,

"merchantCategoryCode" : "1731",

"numberOfTransactions" : 356.0,

"federalTaxWithheld" : 400.0,

"monthAmounts" : [ {

"month" : "JAN",

"amount" : 100.0

}, {

"month" : "FEB",

"amount" : 200.0

}, {

"month" : "MAR",

"amount" : 300.0

}, {

"month" : "APR",

"amount" : 400.0

}, {

"month" : "MAY",

"amount" : 500.0

}, {

"month" : "JUN",

"amount" : 600.0

}, {

"month" : "JUL",

"amount" : 700.0

}, {

"month" : "AUG",

"amount" : 800.0

}, {

"month" : "SEP",

"amount" : 900.0

}, {

"month" : "OCT",

"amount" : 1000.0

}, {

"month" : "NOV",

"amount" : 1100.0

}, {

"month" : "DEC",

"amount" : 1200.0

} ],

"stateTaxWithholding" : [ {

"stateTaxWithheld" : 10.0,

"state" : "NY",

"stateTaxId" : "123-1234",

"stateIncome" : 100.0

} ],

"psePhone" : {

"number" : "7771234567",

"extension" : "111"

}

}

}