Tax1099A_V100

OFX / Types / Tax1099A_V100

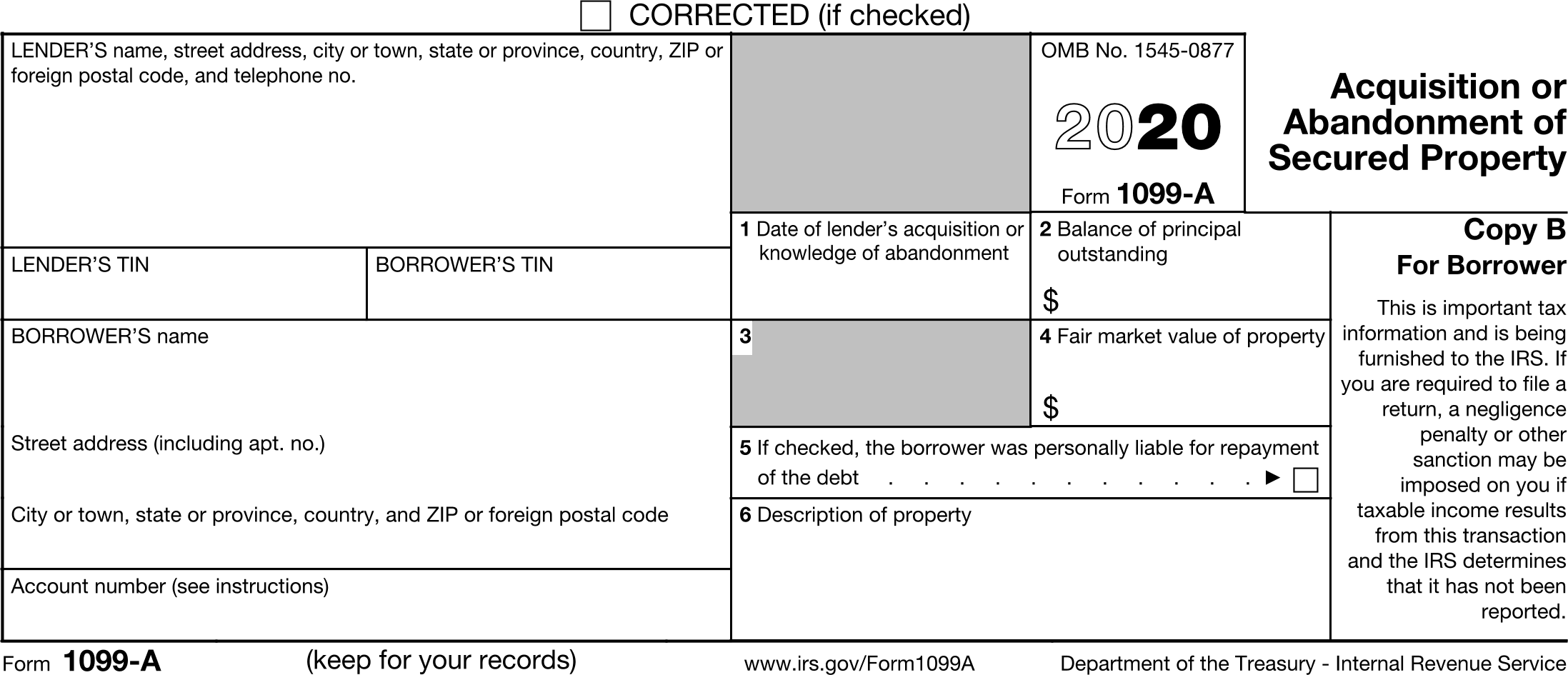

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | VOID | BooleanType |

| 4 | CORRECTED | BooleanType |

| 5 | LENDERADDRESS | LenderAddressType |

| 6 | BORROWERADDRESS | BorrowerAddressType |

| 7 | LENDERID | GenericNameType |

| 8 | BORROWERID | IdType |

| 9 | ACCTNUM | GenericNameType |

| 10 | DATEACQ | DateTimeType |

| 11 | BALANCE | AmountType |

| 12 | FMV | AmountType |

| 13 | PERSLIAB | BooleanType |

| 14 | DESCPROP | MessageType |

Usages:

- Tax1099Response TAX1099A_V100

XSD

<xsd:complexType name="Tax1099A_V100"> <xsd:annotation> <xsd:documentation>Form 1099-A - Acquisition or Abandonment of Secured Property</xsd:documentation> </xsd:annotation> <xsd:complexContent> <xsd:extension base="ofx:AbstractTaxForm1099Type"> <xsd:sequence> <xsd:element name="LENDERADDRESS" type="ofx:LenderAddressType" minOccurs="0"/> <xsd:element name="BORROWERADDRESS" type="ofx:BorrowerAddressType" minOccurs="0"/> <xsd:element name="LENDERID" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>LENDER’S federal identification number</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="BORROWERID" type="ofx:IdType" minOccurs="0"> <xsd:annotation> <xsd:documentation>BORROWER’S identification number</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="ACCTNUM" type="ofx:GenericNameType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Account number</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="DATEACQ" type="ofx:DateTimeType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 1. Date of lender's acquisition or knowledge of abandonment</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="BALANCE" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 2. Balance of principal outstanding</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="FMV" type="ofx:AmountType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 4. Fair market value property</xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="PERSLIAB" type="ofx:BooleanType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 5. If checked, the borrower was personally liable for repayment of the debt </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element name="DESCPROP" type="ofx:MessageType" minOccurs="0"> <xsd:annotation> <xsd:documentation>Box 6. Description of property</xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:extension> </xsd:complexContent> </xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1099MSGSRSV1>

<TAX1099TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1099RS>

<TAX1099A_V100>

<TAXYEAR>2020</TAXYEAR>

<LENDERADDRESS>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

<PHONE>888-555-1212</PHONE>

<LENDERNAME1>Financial Data Exchange</LENDERNAME1>

</LENDERADDRESS>

<BORROWERADDRESS>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

<BORROWERNAME1>Kris Q Public</BORROWERNAME1>

</BORROWERADDRESS>

<LENDERID>12-3456789</LENDERID>

<BORROWERID>xxx-xx-1234</BORROWERID>

<ACCTNUM>111-55555555</ACCTNUM>

<DATEACQ>20200401</DATEACQ>

<BALANCE>200000.00</BALANCE>

<FMV>140000.00</FMV>

<PERSLIAB>Y</PERSLIAB>

<DESCPROP>Unimproved land</DESCPROP>

</TAX1099A_V100>

</TAX1099RS>

</TAX1099TRNRS>

</TAX1099MSGSRSV1>

</OFX>

FDX JSON

{

"tax1099A" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1099A",

"lenderNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"lenderTin" : "12-3456789",

"borrowerTin" : "xxx-xx-1234",

"borrowerNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"accountNumber" : "111-55555555",

"dateOfAcquisition" : "2020-04-01",

"principalBalance" : 200000.0,

"fairMarketValue" : 140000.0,

"personallyLiable" : true,

"propertyDescription" : "Unimproved land"

}

}