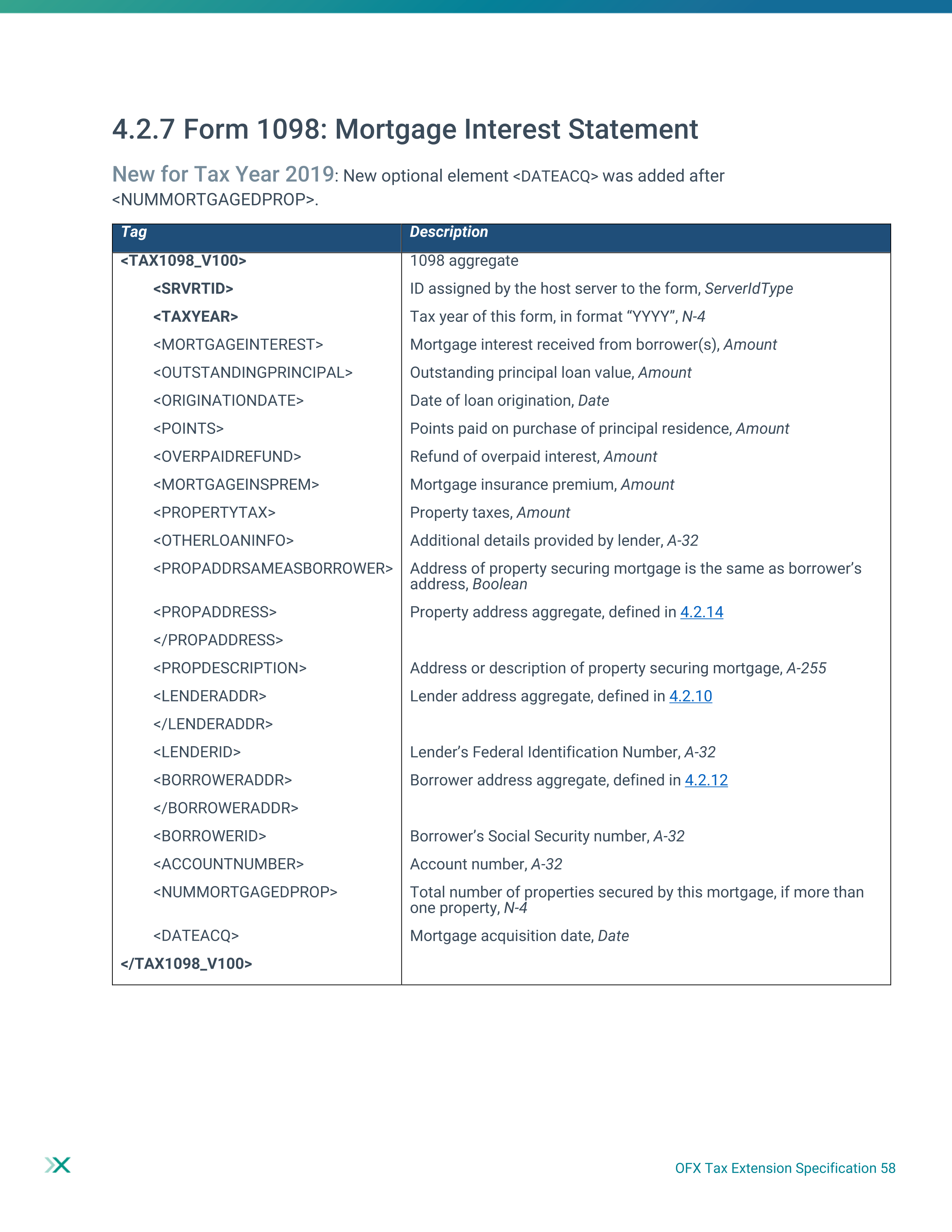

Tax1098_V100

OFX / Types / Tax1098_V100

| # | Tag | Type |

|---|---|---|

| 1 | SRVRTID | ServerIdType |

| 2 | TAXYEAR | YearType |

| 3 | MORTGAGEINTEREST | AmountType |

| 4 | OUTSTANDINGPRINCIPAL | AmountType |

| 5 | ORIGINATIONDATE | DateTimeType |

| 6 | POINTS | AmountType |

| 7 | OVERPAIDREFUND | AmountType |

| 8 | MORTGAGEINSPREM | AmountType |

| 9 | PROPERTYTAX | AmountType |

| 10 | OTHERLOANINFO | GenericDescriptionType |

| 11 | PROPADDRSAMEASBORROWER | BooleanType |

| 12 | PROPADDRESS | anonymous complex type |

| 13 | PROPDESCRIPTION | MessageType |

| 14 | LENDERADDR | LenderAddress |

| 15 | LENDERID | GenericDescriptionType |

| 16 | BORROWERADDR | BorrowerAddress |

| 17 | BORROWERID | GenericDescriptionType |

| 18 | ACCOUNTNUMBER | GenericDescriptionType |

| 19 | NUMMORTGAGEDPROP | anonymous simple type |

| 20 | DATEACQ | DateTimeType |

Usages:

- Tax1098Response TAX1098_V100

XSD

<xsd:complexType name="Tax1098_V100">

<xsd:annotation>

<xsd:documentation>

The OFX element "TAX1098_V100" is of type "Tax1098_V100"

</xsd:documentation>

</xsd:annotation>

<xsd:sequence>

<xsd:element name="SRVRTID" type="ofx:ServerIdType"/>

<xsd:element name="TAXYEAR" type="ofx:YearType"/>

<xsd:element name="MORTGAGEINTEREST" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="OUTSTANDINGPRINCIPAL" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="ORIGINATIONDATE" type="ofx:DateTimeType" minOccurs="0"/>

<xsd:element name="POINTS" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="OVERPAIDREFUND" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="MORTGAGEINSPREM" type="ofx:AmountType" minOccurs="0"/>

<xsd:element name="PROPERTYTAX" type="ofx:AmountType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>Property tax</xsd:documentation>

</xsd:annotation>

</xsd:element>

<xsd:element name="OTHERLOANINFO" type="ofx:GenericDescriptionType" minOccurs="0"/>

<xsd:element name="PROPADDRSAMEASBORROWER" type="ofx:BooleanType" minOccurs="0"/>

<xsd:choice>

<xsd:element name="PROPADDRESS" minOccurs="0">

<xsd:complexType>

<xsd:sequence>

<xsd:element name="ADDR1" type="ofx:AddressType"/>

<xsd:element name="ADDR2" type="ofx:AddressType" minOccurs="0"/>

<xsd:element name="CITY" type="ofx:AddressType" minOccurs="0"/>

<xsd:element name="STATE" type="ofx:StateType" minOccurs="0"/>

<xsd:element name="POSTALCODE" type="ofx:ZipType" minOccurs="0"/>

</xsd:sequence>

</xsd:complexType>

</xsd:element>

<xsd:element name="PROPDESCRIPTION" type="ofx:MessageType" minOccurs="0"/>

</xsd:choice>

<xsd:element name="LENDERADDR" type="ofx:LenderAddress" minOccurs="0"/>

<xsd:element name="LENDERID" type="ofx:GenericDescriptionType" minOccurs="0"/>

<xsd:element name="BORROWERADDR" type="ofx:BorrowerAddress" minOccurs="0"/>

<xsd:element name="BORROWERID" type="ofx:GenericDescriptionType" minOccurs="0"/>

<xsd:element name="ACCOUNTNUMBER" type="ofx:GenericDescriptionType" minOccurs="0"/>

<xsd:element name="NUMMORTGAGEDPROP" minOccurs="0">

<xsd:annotation>

<xsd:documentation>New TY17</xsd:documentation>

</xsd:annotation>

<xsd:simpleType>

<xsd:restriction base="xsd:string">

<xsd:maxLength value="4"/>

<xsd:pattern value="([0-9])"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

<xsd:element name="DATEACQ" type="ofx:DateTimeType" minOccurs="0">

<xsd:annotation>

<xsd:documentation>New TY19. Mortgage acquired date.</xsd:documentation>

</xsd:annotation>

</xsd:element>

</xsd:sequence>

</xsd:complexType>

OFX XML

<?xml version="1.0" encoding="UTF-8" standalone="no"?>

<?OFX OFXHEADER="200" VERSION="202" SECURITY="NONE" OLDFILEUID="NONE" NEWFILEUID="NONE"?>

<OFX>

<SIGNONMSGSRSV1>

<SONRS>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>Successful Login</MESSAGE>

</STATUS>

<DTSERVER>39210131000000</DTSERVER>

<LANGUAGE>ENG</LANGUAGE>

<FI>

<ORG>fiName</ORG>

<FID>fiId</FID>

</FI>

</SONRS>

</SIGNONMSGSRSV1>

<TAX1098MSGSRSV1>

<TAX1098TRNRS>

<TRNUID>_GUID_</TRNUID>

<STATUS>

<CODE>0</CODE>

<SEVERITY>INFO</SEVERITY>

<MESSAGE>SUCCESS</MESSAGE>

</STATUS>

<TAX1098RS>

<TAX1098_V100>

<TAXYEAR>2020</TAXYEAR>

<MORTGAGEINTEREST>1008.00</MORTGAGEINTEREST>

<OUTSTANDINGPRINCIPAL>200900.00</OUTSTANDINGPRINCIPAL>

<ORIGINATIONDATE>20200310</ORIGINATIONDATE>

<POINTS>6013.00</POINTS>

<OVERPAIDREFUND>4011.00</OVERPAIDREFUND>

<MORTGAGEINSPREM>5012.00</MORTGAGEINSPREM>

<PROPERTYTAX>10017.00</PROPERTYTAX>

<OTHERLOANINFO>10. Property tax: $10,017.00</OTHERLOANINFO>

<PROPADDRSAMEASBORROWER>Y</PROPADDRSAMEASBORROWER>

<LENDERADDR>

<LENDERNAME>Financial Data Exchange</LENDERNAME>

<ADDR1>12020 Sunrise Valley Dr</ADDR1>

<ADDR2>Suite 230</ADDR2>

<CITY>Prescott</CITY>

<STATE>VA</STATE>

<POSTALCODE>20191</POSTALCODE>

</LENDERADDR>

<LENDERID>12-3456789</LENDERID>

<BORROWERADDR>

<BORROWERNAME>Kris Q Public</BORROWERNAME>

<ADDR1>1 Main St</ADDR1>

<CITY>Melrose</CITY>

<STATE>NY</STATE>

<POSTALCODE>12121</POSTALCODE>

</BORROWERADDR>

<BORROWERID>xxx-xx-1234</BORROWERID>

<ACCOUNTNUMBER>111-23456</ACCOUNTNUMBER>

<NUMMORTGAGEDPROP>9</NUMMORTGAGEDPROP>

<DATEACQ>20201115</DATEACQ>

</TAX1098_V100>

</TAX1098RS>

</TAX1098TRNRS>

</TAX1098MSGSRSV1>

</OFX>

FDX JSON

{

"tax1098" : {

"taxYear" : 2022,

"taxFormDate" : "2021-03-30",

"taxFormType" : "Tax1098",

"lenderNameAddress" : {

"line1" : "12021 Sunset Valley Dr",

"line2" : "Suite 230",

"city" : "Preston",

"state" : "VA",

"postalCode" : "20191",

"country" : "US",

"name1" : "Tax Form Issuer, Inc",

"phone" : {

"number" : "8885551212"

}

},

"lenderTin" : "12-3456789",

"borrowerTin" : "xxx-xx-1234",

"borrowerNameAddress" : {

"line1" : "1 Main St",

"city" : "Melrose",

"state" : "NY",

"postalCode" : "12121",

"country" : "US",

"name1" : "Kris Q Public"

},

"mortgagedProperties" : 9,

"otherInformation" : "10. Property tax: $10,017.00",

"accountNumber" : "111-23456",

"mortgageInterest" : 1008.0,

"outstandingPrincipal" : 200900.0,

"originationDate" : "2020-03-10",

"overpaidRefund" : 4011.0,

"mortgageInsurance" : 5012.0,

"pointsPaid" : 6013.0,

"isPropertyAddressSameAsBorrowerAddress" : true,

"acquisitionDate" : "2020-11-15",

"propertyTax" : 10017.0

}

}

OFX Tax Specification Page 58